Summary

In this article, we look at 11 of the biggest companies in the world and their valuation.

We also look at the upside or downside over the next two years.

There is only one stock that looks very overvalued and could be a candidate to short if you do that (I don't).

Hi friends

At Potential Multibaggers, I mainly focus on high-growth stocks, but many of us, including me, also have positions in some of the best and biggest companies in the world. For those stocks, I think valuation is very important and that's why I wanted to dedicate an article to this.

In this article, I will have a look at the potential return for the next two years of 11 mega caps. That means it's very speculative, as you never know what the stock market will do as a whole and these stocks in particular. Sometimes, stocks can be overvalued or undervalued for a long time, so take this with a grain of salt, please.

On top of that, these are not elaborated DCF models with base, bear and bull cases, but snapshots. But more work doesn't always mean more accuracy in valuations.

Despite the flaws, I think this exercise can be helpful in determining which position to add and which not.

One last remark before we start, the potential upside or downside is not per year, so no CAGR but total return potential. All of these charts are from Fast Graphs.

Apple

Let's start with the biggest company in the world, Apple (AAPL).

For Apple, the best way to evaluate it is Free Cash Flow. As you probably know, the company is an FCF machine. Let's look at the valuation.

FCF shows Apple's stock is quite a bit overvalued. No matter which metric you take (PE, EV/EBITDA, OCF...), it always looks overvalued quite a bit. Warren Buffet started his position in 2016, when the stock was undervalued based on FCF. And jumping in and out of stocks is not his or my style. But right now, I wouldn't start a position in Apple.

Potential downside in the next 2 years: 30%.

Microsoft

For Microsoft (MSFT), P/EBITDA is a good measuring stick. You can also see the stock price has evolved in line with EBITDA.

Right now, the stock seems a bit overvalued, but not too much because of the growth the company is expected to have.

Potential return in the next 2 years: more or less flat.

Amazon

Jeff Bezos has said early on that P/OCF is the best way to value Amazon's (AMZN) stock and the correlation between the two is remarkable. OCF is often a good ratio for retail stocks in general, by the way.

Judging from the P/OCF, Amazon's stock is seriously undervalued.

Potential upside in the next 2 years: 100%

Alphabet

Let's look at that other tech giant, Alphabet (GOOGL) (GOOG).

It may be a bit of a controversial choice, but I also take P/OCF, as Google also still invests heavily in its moonshot projects. You can also see that the correlation between the stock price and EBIDTA has been remarkably close.

The stock looks slightly undervalued at this point.

Potential return in 2 years: 35%.

Berkshire Hathaway

How about Berkshire Hathaway (BRK.B) (BRK.A)?

Warren Buffet prefers "owner's earnings," aka free cash flow, so let's value his stock on this metric.

Berkshire usually trades at a premium, and rightly so, but right now, it looks severely overvalued.

Potential downside next 2 years: 30%, in line with Apple, which makes sense.

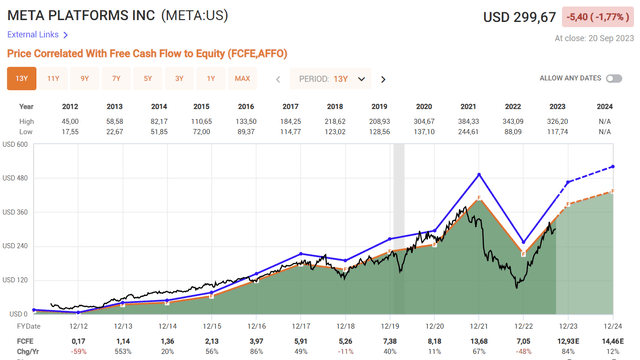

Meta Platforms

Meta's (META) stock price correlates closely to its free cash flow. Even the big drop in the stock price was in anticipation of the big drop in free cash flow, and the recovery of the stock and FCF also shows a striking resemblance.

Potential upside next 2 years: 45%.

Despite the big surge in the stock price this year, there is probably more upside in Meta's stock price.

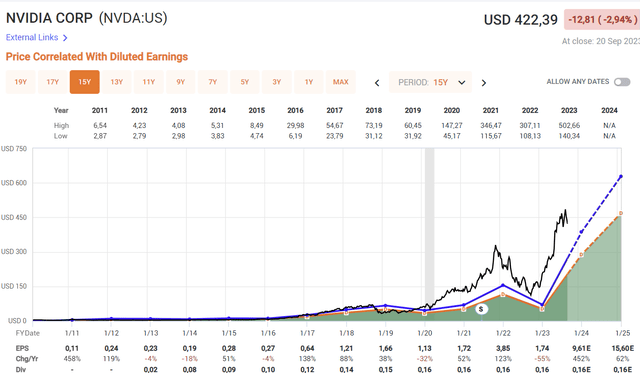

Nvidia

Aaaah, Nvidia (NVDA), every value investor's nightmare. Let's take diluted earnings, which should, of course, be looked at in the context of Nvidia's explosive growth.

Potential upside in the next 2 years: 30%.

I have been conservative here. If you look at the blue line, that's Nvidia's long-term average, the orange line means a PEG of 1, which I think is low for such a premium quality company. I have taken the average of the two and get to 30% in that way. But the blue line represents 45% upside.

Tesla

And from Nvidia to another thorn in value investors' side: Tesla (TSLA). Even for me, an experienced growth investor, the valuation didn't make sense for years. Only when the stock went under $200 at the end of 2022, I hit the buy button several times, with an average buying price of $166.

As Tesla is still investing heavily in new technology and new factories, I think a valuation based on P/EBITDA makes sense here.

You see that the stock was severely undervalued on this basis during the last months of 2022 but that it still hasn't caught up to its orange line, which would put its EBITDA-based valuation in line with its growth.

Potential upside in the next 2 years: 125%.

Eli Lilly

Maybe you hadn't expected Eli Lilly (LLY) in this list, as it's not as broadly discussed as the other stocks in this list. But it has a current market cap of more than $500 billion, pushed by the 85%+ return over the last year.

I have chosen for P/FCF but no matter how you value Eli Lilly, it looks very overvalued.

BUT, the company has Mounjaro, a drug that has shown impressive weight loss numbers, even better than Novo Nordisk’s Ozempic. On top of that, it can be taken orally. It could be the huge success and hence the “overvaluation.”

Visa

To me, it looks like Visa's (V) stock is best valued on a P/EBITDA basis. If you look at the long-term stock price evolution in correlation with EBITDA, you see that they are quite parallel, except for the last few years.

It also means that Visa's stock looks slightly overvalued right now. Its growth means that there is an upside nonetheless.

Potential upside next two years: 15%

Mastercard

No Visa without Mastercard (MA) and that's why I made this a list of 11 companies, not 10. And I think it's no surprise to see a similar pattern as with Visa.

Mastercard looks a bit overvalued, even a bit more than Visa. But the company is also expected to grow its EBITDA at 15% instead of 12% for Visa. That means that the potential is equal to that of Visa. Again, not surprising.

Upside potential for the next 2 years: 15%.

Conclusion

I hope you enjoyed this article. Again, take these predictions with a big grain of salt. There are no absolute truths in investing and more particular in valuations, just opinions.

In the meantime, keep on growing!

Thanks Kris for the Interesting perspective ,

in depth coverage and

quantifying the analysis to price targets !

Chris - brilliant work thanks - As a GARP investor I feel that always looking for a Margin of Safety is a good thing .

Nevertheless as your sort was simply focused on the mega caps - your analysis on each one is much appreciated