Summary

Bonds are a larger market than stocks and have different types, such as US Treasuries and corporate bonds.

Bond prices and yields move in opposite directions, and longer-term bonds are riskier.

The 60/40 rule of investing in stocks and bonds has been effective due to declining interest rates, but correlations between stocks and bonds can change.

What does this all mean for your investments?

Hi friends

This is a new start for this blog.

Up to now, this blog has been mostly a side project for me, next to running Potential Multibaggers and Best Anchor Stocks. What I released here were small snippets of articles that I write for Potential Multibaggers. From now on, you will be given more full-length articles regularly. For free, yes. So, if you are not subscribed yet, don’t forget, so you don’t miss these articles.

I think you will see the level will be much higher than what you were used to here. And I won’t cover it up, I will launch a paying service here over time. Don’t worry, there will always be free articles. I don’t know yet when I will start the paying service, but not in the first weeks, so in the meantime, you get everything for free. This is premium content that is usually hidden behind the pay wall but you get it for free now, also because you then know that what I usually bring here is not even 10% of the value of what subscribers to Potential Multibaggers get.

So, for a few months, I’ll publish premium content here for free, at least in the first two weeks after the article is published, so that’s why it’s so important, if you haven’t done that yet, to hit that subscribe button right now.

While I write most articles at Potential Multibaggers myself, a few fantastic authors help me. If you follow along, you’ll get to know them. This article, for example, is from Karan.

Let me first introduce you to Karan. Karan is 34 years old and was born in India. He has lived in various countries, including Japan, Malaysia, the US and Singapore. He moved to Singapore in 2017 and considers it home, although he is currently living in New York City for a 6-months assignment. In Karan's words:

I work in finance, for a large multinational bank, where I have a range of responsibilities primarily on the credit side in wealth management. I have past experience in transaction banking, equities technology, asset management and consumer operations.

The floor is for Karan now.

Hi there!

I wanted to dedicate this article to a slightly more technical topic, but one, I hope, will help you make sense of the barrage of noise we see on Twitter (they can pay me to call it X if they like) or the Cartoon Network. And, of course, Kris’ Twitter account (@)fromvalue is an exception.

By the end of this article, you should be able to answer the following questions:

What does it mean when reports say the 10-year yield is above 4.5% and could go higher?

What does it say about the economy in particular?

Are stock prices and the 10-year yield correlated?

I only invest in stocks; why should I care about yields?

Why do my stocks keep going down every time Jerome Powell speaks?

What does it mean to invest in stocks for the long term?

But first, we have to take a step back from stocks and start with bonds. No, not these Bonds.

We're talking about those with a small letter b. Why talk about bonds first? Because bonds came first, are a bigger market and determine much of what we see in the stock market today.

Section 1: Bond Yields & Interest Rates

The first thing to know about bonds is that they are more complicated than stocks. Anyone who says differently either works as a bond trader or is trolling you and wants you to feel stupid.

The second thing to know is that the bond market is extremely large and confusing. Let’s explore some basics about bonds, the second largest asset class in the world (after Real Estate).

Yes, dear friends, the bond market, roughly 127-130 trillion globally, is larger than the stock market, roughly 120-125 trillion globally. (Source: The Capital Markets Fact Book). Though the difference might look small, it is roughly the size of the UK economy. Let that sink in for a minute. Are you back after that minute? It might remind us all that no company exists in a vacuum.

Now, what is a “bond”?

In the simplest of terms, it’s a contractual obligation between one or more parties to borrow a sum of money, to be repaid at some point in the future and a little extra thrown in for the trouble. After all, why bother loaning your money, right?

As such, there are different kinds of bonds. Let’s focus on the US for the sake of simplicity.

US Treasuries also known as Sovereign Bonds – Issued by the government (We will focus on these)

Corporate Bonds – Issued by Companies (Public or Private)

Municipal Bonds – Issued by cities, counties, states, public institutions

Agency Bonds – Specialized instruments. Ever heard of Fannie or Freddie?

Mortgage-Backed Securities – Invented by Wall Street in the 80s because there just weren’t enough things to charge for. Basically, day trading other people’s home loans.

You may have heard other related terms like “Investment Grade” or “High Yield,” but these are credit-related subcategories of the above, so we’ll ignore them for now to avoid making this too long. The same for more exotic categories like “TIPS’, “Convertibles”, “ABLs”, “CLOs” etc etc.

So, unlike equities, you have to be clear about which bonds you’re referring to because they behave very differently. Also, bonds have certain unique features:

They usually pay some interest (though not all of them)

The interest might be fixed or variable (sometimes both, it depends)

They are usually issued for a fixed term (not all)

Some of them can get redeemed early (it depends)

This gives us a helpful framework to analyze stocks as well:

Some stocks pay out a dividend (though not all)

The dividend is generally variable

Stocks are usually issued in perpetuity

Some can redeem early (preferred shares or outstanding shares canceled via buybacks)

There is always certainly a better deal elsewhere

Keep this framing in mind; we will come back to it shortly.

Let’s also spend a minute on treasuries because they will be the basis for the rest of the article. After this point, whenever I use the word “bond”, I am referring to US government bonds.

US Government Bonds (known as treasuries because they are issued by the US Treasury) are backed by the full faith and tax-collecting power of the US government. The government issues the bond to accept money from you, uses it to invest in infrastructure or defense or pay salaries to government employees, etc.

Hopefully, by spending the money wisely, they can facilitate economic growth and, by extension, grow the tax base. They then collect taxes and use that money to pay you back with interest. The shorter the bond, the safer it is. The longer the bond, the riskier it is. This is why the 10-year treasury is widely known as the “Risk-Free” rate because the standard assumption by market participants is that the US government will always be able to pay you back over a 10-year period.

But that’s just definitions; the real fun is in the dreaded “Bond Math.”

Bond Math

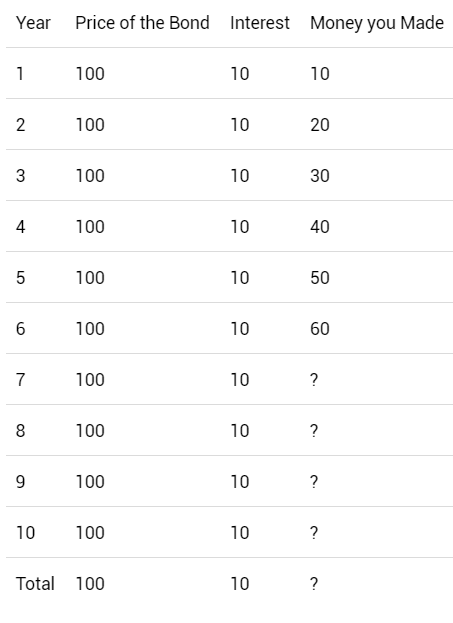

Let’s say you buy a bond worth $100 that pays you 10% as interest every year.

Your investment would look a little like this:

So, if you hold the bond to maturity, you get paid $10 per year and then get your original principal ($100) back at the end, balancing out to a total of $200. Not a bad deal if you can find it.

Now let’s pretend a mysterious dark force, let's call it Fed, raised rates by 5% and now a new bond is issued, also worth $100 but of course, this one pays an interest of 15%. So, the math would look a little like this:

Looks like an even better deal? An extra $50 for the trouble of holding this new shinier bond. But of course, dear reader, you now have a problem, which is that you only had 100$ to spend and you already own the first bond. Not a problem, you would think, as you can sell it, get back the $100 and buy the new one. Right? Well, it's not that simple.

Who would you sell it to? Every buyer in the market knows there’s a newer, shinier bond for the same price, so why would they buy it from you and get a lower payout?

The answer, as you might have guessed, is to sweeten the deal by selling it for a lower price, such that the existing $10 coupon gives them the same yield of 15%.

In mathematical terms:

(10/X) = (15/100)

X = 1000/15 = 66.67

Wait a minute, $66.67? That’s a lot lower than 100! 33% lower!

And yet, only at that price are the two instruments the same over the next 10 years.

This, ladies and gentlemen, is the essence of bond math. For the sake of completion, here’s the reverse example, a bond with only 5% interest

What’s the price of your 10% yielding stalwart now?

(10/X)=(5/100)

X = 1000/5 = 200!

Yields cut in half; the bond doubled in value. Easy peasy.

Always remember the golden rule of bonds = Yields and bond prices ALWAYS move in opposite directions.

But all of the above assumes that the transaction takes place in Year 1. What about if you tried to do this in Year 7?

Now the new buyer has to make an additional calculation because they will only get paid $40 and not $100, since you already took the first $60. How much would they be willing to pay for this bond to get $150 overall, or a 15% yield?

X + 100 (original Principal) + 40 (remaining interest) = 150

X = 10.

That’s right. If you tried to sell this bond in Year 7, you’d have to do so at $10, a 90% discount to compensate the buyer. Don’t feel too bad, you’ll have, overall:

10 (Price Sold) + 60 (Collected Interest) – 100 (Original Principal) = - 30.

So, you take the interest of one more year and then this is exactly what remains of the original bond – see how that worked out?

And we haven’t even talked about inflation, convexity, time value etc, etc.

If all that puts you to sleep, well, it’s a reminder why most individual investors don’t trade individual bonds or if they do buy them, it’s easier to just hold to maturity and not run a bond trading desk from your house.

Remember the Rules of Bond Math:

Bonds issued in the past respond to interest rates, rate of inflation, credit & duration because their yields are constantly measured against alternatives. Today, 3-month yields tend to match the Fed funds rate and set the base for all other yields.

Starting yields determine most of the return for bonds, no matter what you do. Yield Go Up = Bond Prices Go Down; Yields Go Down = Bond Prices Go Up

Generally, long-term bonds are riskier (because life happens) and should yield more than shorter-term bonds. This is called a “Steep Yield Curve” since it rises over time. When short-term bonds pay more than long-term bonds, the Yield curve “inverts.” This happens when the Fed raises short-term rates sharply, but long-term rates don’t move as quickly.

We have had this condition for over a year now. The longer the duration of the bond, the more sensitive it is to changes in interest rates. A 1-year bond will hardly move if yields go up, but a 30-year bond will get annihilated because it has to cover more future interest. A rule of thumb is that a 10-year bond will decline 10% for every 1% increase in rates. It will appreciate 10% for every 1% cut in rates. Inflation is bad for bondholders. Deflation is good for bondholders.

Section 2: How Bonds Relate To Stocks

The bread and butter of the modern asset management industry is known as the “60/40 Rule", which means 60% of your money in stocks and 40% in bonds. Why did this take hold?

This is why:

Source: Interest rates - Long-term interest rates - OECD Data

What you see above is a 40-year almost uninterrupted decline in interest rates from a high of about 15% in 1980 to 0% and, in many places even, negative!

If you remember bond market math, declining interest rates are basically free money and this was so effective that basically, during the March 2020 crisis, long-term bonds had outperformed stocks over 40 years (1980 – 2020).

I repeat, when bonds started at high yields in the 1980s, this was such a powerful tailwind that you could have bought every 30-year bond you could afford, gone to the beach for 40 years (!) and outperformed stocks without any risk. No wonder “bond kings” got so famous.

This also leads to the happy accident that:

Stocks decline in bad times (GFC, COVID, 2000 recession) -> The Fed cuts rates -> Bonds go up -> people rush into bonds as a “safe haven” – Bonds > Stocks.

This happened repeatedly in every single decade, including the 2020 COVID crash (the longer duration, the better). For visual learners, here is a chart of TLT (20 year) vs SPY from Jan 2007 to March 2020.

What you see here is long-term bonds crushing stocks for a 13-year period, which is a career for many pros. If ETFs existed in the 1980s, this would show an even starker gap.

So, if bonds are so great, why doesn’t everyone pile in? Because correlations are not static and change over time.

From the folks at AQR: A Changing Stock-Bond Correlation

There are periods in history when stocks and bonds move together (correlation > 0). We have just been intensely fortunate to have lived in the period when they didn’t and bonds acted as a safe haven.

In 2022, this picture unwound itself and bonds and stocks started to move together. Unfortunately, they both went down together. For bonds, the effect was devastating. Look at this tweet, for example.

And so, we started seeing headlines like these:

Why Schwab Believes Short-Duration Stocks Belong in Your Portfolio | Nasdaq

Risks and Rewards of Long-Duration Stocks | Cerity Partners

Unfortunately, the news very often does a fabulous job of talking down to readers and missing any context explanation. What exactly does it mean to own a “long duration” stock vs. a “short duration” stock?

As we explored above, “duration” is just a fancy term for maturity. A bond that matures in 30 years has a relatively “long duration” compared to a bond that matures in 1. So far, so good, but stocks don’t “mature” in the traditional sense.

When a company is formed, it expects to exist for pretty much forever. In fact, legally, companies are immortal entities that can only die through extreme events such as war, bankruptcy, privatization, liquidations, etc.

If you launched a small shop in your backyard to help out with basic repairs for the neighborhood shrine in 578 AD and time-traveled to the present day, you could still find it alive and kicking, paying employees and taxes even today.

If the date seems oddly specific, that’s because it’s real - Kongō Gumi - Wikipedia. For those keeping count, that’s over 1400 YEARS of continuous operation. Capitalism for the win!

(And the above is not an isolated example, there are several known companies > 1000 years old - The Oldest Companies Still Operating Today - WorldAtlas)

Now, you may say, cute story, but that’s a family business; what do we care as investors? Stock markets weren’t invented in the 6th century! You would be correct, but they were invented eventually and the record of publicly traded companies isn’t terrible either - 100 Oldest Publicly Traded Companies - Stock Analysis. If you look hard enough, you can find stock of BNY Mellon, first issued when it went public in 1792!

The point here is when a company issues stock, they expect it to last pretty much forever (as long as they don’t get taken private or go bankrupt) and as such, there’s no expected “maturity” when you get your original principal back.

So, to repeat, what is the duration in equities? To be clear, let’s define what duration is NOT:

It has nothing to do with the age of a company. A 4-year-old company can be shorter “duration” than a 25-year-old company.

It has nothing to do with the “return” of a company. A company can have a price return of 100% in 1 year and be longer “duration” than one with a return of 10% in 10 years.

The answer dear friends, is all about capital return i.e., how quickly can a company pay back its shareholders.

There is a class of investors who believe the only stocks worth buying are those that pay dividends and that those that don’t are worthless. Why? Because there is no way to claim the cashflows produced by the company. These folks swear by the Dividend Discount Model, which means, no dividends, no cash return, no stock price.

The thinking behind this is that stock prices are inherently unpredictable over the long run, “A Random Walk” in the words of Burton Malkiel. (It’s a book Kris hates, by the way.) Therefore, they should be treated like any other investment, i.e., how much do you get back for what you put in?

For a bond that’s straightforward, return = whatever the yield at purchase (assuming the bond is held to maturity & principal is paid back in full)

For a stock, the dividend substitutes the interest payment. As such,

“A Stock is a Bond with Infinite Duration. But unlike a bond, there is a wide range of outcomes between now to infinity.”

Both bonds & stocks are issued by companies in order to raise money, but corporate bonds are senior claims (they get paid back first in case of bankruptcy) and the most you can make is the interest paid by the bond. Stocks represent ownership in the company and the theoretical upside is infinity.

A stock that pays dividends is a “shorter duration” asset (relative to other stocks, like a bond) because an investor starts to experience cash returns immediately. Buy a stock that pays 10% a year in dividends and you will get your money back in 7.2 years. Everything after that is pure profit – this is the dream of every dividend investor. Of course, you have to assume no dividend cuts, principal losses etc, but let’s not worry those investors too much now.

Another variation is the dividend growth style, where one may buy a low starting yield but over time, with continuous reinvestment, yield on cost can rise as the company increases its dividend.

A pure growth stock that doesn’t pay anything is a “long duration” asset because all of its return is in the future, when it will (maybe/hopefully) start paying out its cash flow to shareholders.

Viewed through this lens, an investor will always buy Altria (PM) with an 8% yield over Amazon (AMZN), with a yield best described as “maybe never”) as hinted in point 2 above.

Now, one may quibble with this line of thinking given the price return of Amazon since its IPO far exceeds that of Altria. However, the dividend maximalist would counter – that’s only due to price return and another dotcom style crash of 90% would wipe that out. On the other hand, since Altria first became public in 1926, it has created more wealth through dividends in its entire history and that’s cash in the bank that can’t be touched by a panicky Mr. Market.

This author is not one to take sides but will make a few observations:

1. HODLing AMZN since IPO gave you life-changing returns, except maybe nobody did other than the Motley Fool's David Gardner and Jeff Bezos himself. And they still don't pay a dividend! Will it give the same return in the future? No idea; this is the price of holding an asset with an unknown terminal value.

2. An Altria type of investment can generate enormous returns for many generations of a family based on the strength of its business model. Will it do the same moving forward? Who knows. It will probably continue to pay until it liquidates itself in 10/20/50 etc. years (depending on your bias). But you could get rich from it, unless you're already rich and can buy a truckload of shares for the yearly dividend.

3. In a 2020-style regime of 0% rates and infinite money, when every stock and its uncle is in the midst of “rocket ship” “rocket ship” “WGMI” (we are going to make it) – a long duration investor will ride the wave, call it their own genius in identifying the future of disruption and produce ads making fun of short duration investors (If you know, you know; hint: Cathy).

In a 2021-2022 regime of fastly increasing rates and rising cost of capital, the short-duration investor will collect their dividend checks and will tell you how bubbles always burst and “lost decades are more common than you think” etc etc.

4. A reasonable person might say this is cherry-picking to illustrate the point and over the long run, it doesn’t really matter; only Total Return does!

This author would agree, every Dog has its day: (since the ARKK IPO)

5. There is no right or wrong strategy; whatever helps you meet your own goals, and fits your character but there are many, many ways to make money in the market.

Readers should understand that when Wall Street talks about “duration”, it’s a fancy way of pushing stocks that pay out their cash flows in one time horizon over another. In other words,

Long Duration = Stocks that don’t pay dividends (but may someday) = Generally Growth Companies.

Short Duration = Stocks that pay dividends = Generally more mature companies (that pay you now & may overlap with traditional value companies)

Section 3: Macro Summary of the story so far

So, let’s summarize everything we’ve covered today and tie it all together:

For about 40 years, interest rates declined, and hence, bonds went up. This was regardless of whether the economy was “good” (late 90s) or terrible (2008 GFC). Crucially, they also went up in periods when stocks declined and hence acted as a stabilizer to the portfolio.

Asset prices across the board went up, and people in general got richer and required more “safe places” to park their funds. This demand further increased with the rise of annuities and target date funds, which have a mandate to hold a certain % of assets in bonds.

The government took advantage of this environment & demand for bonds by issuing increasing amounts of debt at lower yields. In 2020/2021, bonds yielded approx. 1%, which many considered to be too low, so people would buy fewer bonds and more stocks, which pushed up the prices of stocks.

Then when inflation hit, the Fed started raising interest rates fast to combat it, hoping that it would raise the cost of doing business for everyone and, as a result, demand would go down, dampening inflation.

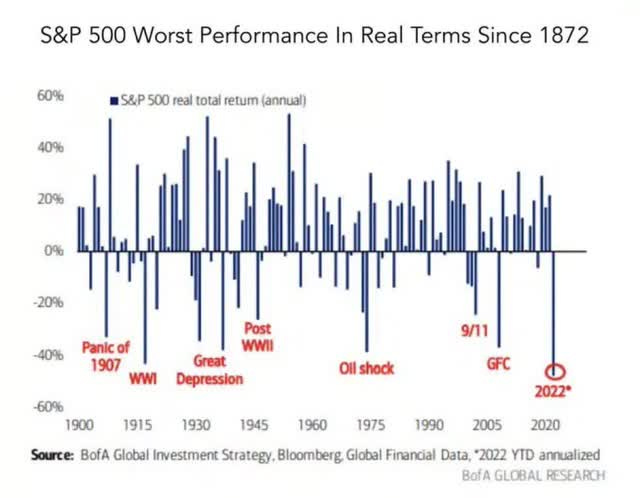

Suddenly, new batches of bonds yielding much higher rates started to enter the market, and this caused the price collapse of all the existing bonds in the market (like we saw above) and bonds had one of the worst years in their entire history.

Stocks, as we saw earlier, are simply longer-dated bonds to some, so they fell even more. Simply put, why would you invest money in something that MIGHT pay you back in 40 years when you could guarantee 5% over the next year? And so people started selling some stocks too and buying “safer” short-term bonds

The Fed kept hiking, at the fastest rate in their history & stocks and bonds both kept falling, and in fact had their worst year since 1876, which is a long time ago and for most people reading this, their grandparents were not even born.

This leads us to the present day, where inflation has come down significantly, rates are high and the Fed has indicated that they may remain high for a while.

This caused bonds to sell off AGAIN in 2023- People are factoring in higher average rates for 2024/5. So a 2-year matures in 2025, if you believe in “Higher for Longer”, then that’s the entire term. This means people will sell longer-duration assets, like stocks, and 30-year bonds, to lock in higher rates over the next few years.

Unfortunately, the Fed has a terrible track record of predicting what the Fed will do - Nobody Knows Anything, Dot Plot Edition - The Big Picture (ritholtz.com)

Every self-appointed macro guru and their mother has written and screamed that this is a mistake, the Fed will cause a recession by keeping rates too high for too long – the problem is I have been reading these claims since April 2022 and I was promised a recession was only six months away. Eighteen months later, the recession is definitely still six months away. I have absolutely no idea when there will be a recession. Nobody does. The economy has remained strong despite higher rates and every doom-monger has been wrong. Some day, they will be right, until then I will continue to mute them.

Section 4: What is YOUR Duration? As an Investor?

There are many different ways to make money in the market; the one thing you cannot control is starting conditions, i.e., when you start to invest. Depending on this single factor, you will have wildly different outcomes and attitudes to investing. For those who started in 2009 or 1982, it’s been a fabulous ride. For those who started in 2021, not so great.

Too often, people talk past each other when it comes to individual companies and we see discussions around “lost decades” and “CSCO, ORCL never recovered their 2000 high and MSFT took 15 years”.

Seen from a different lens, would you judge the return of a 30-year bond after only 15 or 20 years? And yet, that’s exactly what we’re doing when we look at short-term price charts of stocks. Frankly, even ten years is a “short” duration for a stock that, in theory, can last for centuries.

You may counter that you don’t have 30 years to invest, or your goals are only 10 years away; what then? Fortunately, you don’t have to pour all your money into growth stocks. Perhaps you can own a mix of assets that aren’t 100% equities. That’s where asset allocation and diversification come in. The right “duration” for your portfolio is whatever helps you meet your needs.

As investors, we have various options on how to invest

“Safer” bonds – If 5% yields are enough for you, it’s a golden opportunity to buy “Riskier” stocks with dividends. If you like to own stocks but don’t feel comfortable waiting forever (assuming you can find the right ones or just buy index funds or income funds)

“Even Riskier” stocks without dividends, but high FCF and the ability to re-invest.

If you don’t need the money in the next 10-20 years and can identify the best companies, these can offer an option to give you returns higher than 1 & 2 Alternatives or trend following or any other options outside of the traditional 60/40 depending on your competence/comfort.

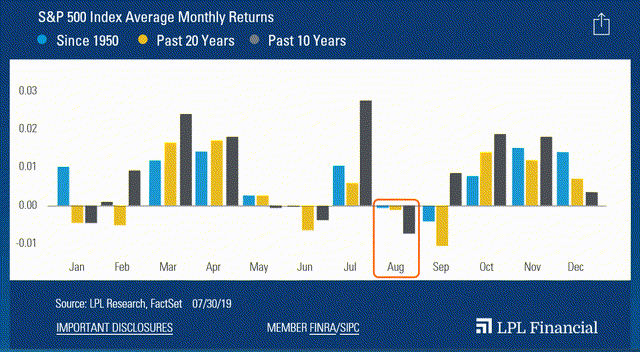

We can end this note with a simple example. The recent price action in the months of August and September 2023 were very bad. It’s brought the bears out of the woodwork (again) and gotten people worried we were in for another world of pain. We saw and still see words thrown around, such as inflation, interest rates, rising yields, and recession – all scary and all problematic. Perhaps one or all of them will be a factor in future returns over the next couple of years.

If anything, it can be hard to visualize what the future looks like - we have already endured 3 bear markets in the last 5 years (Q4 2018, Q1 2020, 2022). But we have also endured a “bubble” between the last two. Perhaps we are in for another “lost decade,” and the bad news is just beginning.

Or perhaps, if we zoom out, it’s just business as usual:

Source: S&P 500 Index Average Monthly Returns | LPL Financial Research (lplresearch.com)

Source: Weakest Time For Stocks - All Star Charts –

It seems like that period again showed the weakest period of a presidential cycle (going back 50 years) and, indeed, the weakest period of the year (based on the last 20 years) and stocks were weak. (Insert your favorite shocked.gif here).

Does this mean they will go up the rest of this year? I have absolutely no idea.

I try to remember that I am a long-term investor, aiming for a maturity of about 30-40 years when I expect I will need the money. Time is my friend.

And that If I zoom out, the market has truly seen it all before. Not to say you should blindly buy and hold, but that you should choose your own time horizon wisely.

Conclusion

This was a long article, so I hope you are still here. Let me know in the comment section if you have more questions!

In the meantime, keep growing!

Brillant article !