Hi

There has been a lot of news about SVB, the Silicon Valley Bank. Maybe so much news that you never really fully understand what is going on. I have seen some really bad takes of people who shout but don’t get what’s going on. I hope this article can help you cut through the noise.

I'm not a banking expert, not at all and I will not pretend to be one, unlike many others now.

But if you read the right things, you can understand many things. You just have to be willing to put in the effort. The more complicated people make their story, the less value it brings. That's why I love Marc Rubenstein's breakdown of what happened at SVB and I base my explanation for a big part on his article. If you want to know more details than I provide here, I recommend reading the whole article.

Before we start, I want to make sure that you understand a few things are not true:

This is not a credit crisis

This is not the consequence of the zero-interest policy

This is not comparable to 2007-2009

This is not because of crypto

This is not because of ‘unprofitable tech.’

I have heard all these explanations, and that’s why I wanted to start there. But if this is not all of these things, what is it then?

This is where it all starts with. The crash in bonds.

(Source)

As you can see, the bond market has never crashed so fast and so much in the last 50 years. The reason is, of course, the unprecedented rate hikes from the Federal Reserve. Put simply: if you have a bond yielding 0.25% and now you can get a bond yielding 5%, you know that selling the 0.25% bond will be hard and you will have to sell them for less than they are worth.

Another possibility is to hold them to maturity. Banks must earmark the bonds they own, either HTM (held-to-maturity) or AFS (available-for-sale). They have to do this beforehand. Changing AFS bonds to HTM is possible, which means they become de facto illiquid. Selling a single HTM bond means you have to re-rate all of your HTM bonds and with the big crash, that would mean massive losses. Paper losses have consequences for the bank, as it has to fulfill its legal obligations of enough value in high-quality assets.

The problem with AFS bonds is that there is much more volatility and regulators are strict there, as the value of assets has to be high enough to remain within the boundaries of the rules. That means many banks switched their AFS bonds and gave them HTM tags. JP Morgan, for example, changed $342 billion in bonds from AFS to HTM.

During the pandemic, a record of new deposits came flooding in. This is the graph for SVB, for example.

(Source, the red arrow represents the start of the pandemic)

Deposits rose by $5.4 trillion. This caused a problem. One of the banks' preferred ways of putting that money to work is loans. But the demand for loans was very weak and just 15% of that giant mountain of money was used for loans. The rest was invested in securities, or just kept as cash. This also happened at SVB but more extreme. Between the end of 2019 and the first quarter of 2022, SVB's deposits more than tripled to $198 billion, while the overall industry saw "just" 37% growth.

SVB invested a lot of that extra money it got in deposits in bonds, both AFS and HTM, but with much more HTM, also because some underwater AFS bonds were rebranded as HTM.

(Source)

The average maturity of the bonds was 6.2 years. But with interest rates going up so fast, losses rose. Of course, these were just paper losses, but a bank must have enough liquidity and assets to be solvable for regulators.

As you can see in the above chart, starting in the second quarter of 2022, SVB's customers began taking money from their deposits. One of the main reasons why SVB's deposits had gone up so much is because many tech companies got a ton of venture capital money or made a second offering during the stock market rise following the pandemic crash. With higher interest rates and economic headwinds, VC money started drying up, and the market also didn't want companies to sell more shares. That means companies began using their cash reserve to operate and grow. Deposits fell from $198 billion to $165 billion at SVB.

To be able to give customers their money, SVB sold AFS bonds for $21 billion. But the loss on that sale, $1.8 billion, counts for its regulatory capital position and therefore, SVB also needed to raise capital. That would have probably passed without much noise, but unfortunately, SVB's capital raise was announced on the same day Silvergate Capital announced that it would go into voluntary liquidation for the same problem SVB had. That caused panic.

When VC firms advised their companies to withdraw their money from SVB, this caused a bank run. About a quarter of deposits were drawn in one day, $42 billion. Raising money failed because of the unfortunate timing, so SVB became undercapitalized. It tried to sell, but that caused even more panic.

That's why the Federal Deposit Insurance Corporation ('FDIC') came in and took over.

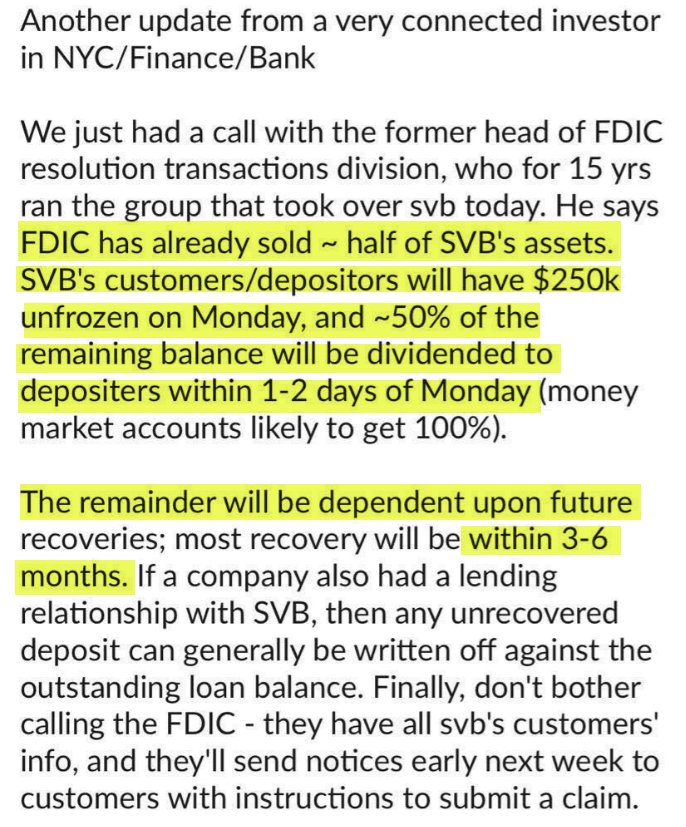

Matt, one of the Potential Multibaggers subscribers, shared this:

Hi, CEO of an SVB client here. The last 24 hours have been awesome. (clearly ironic). Expectations are that all deposits will eventually be covered, but it will take a couple of weeks to work through the process. I don’t expect a financial contagion, but unfortunately, some companies won’t make it, and the VC community will be under even more stress than it was before.

Later, Matt shared this:

(My highlights)

Thanks to Matt, at Potential Multibaggers, we already knew on Friday that things probably were better than most feared, as SVB’s troubles also sent panic through the ranks of investors. I put out a poll on Twitter asking if this is the first domino to fall or if it will be just a footnote looking back. These are the results.

Until the last few hours, it was 50/50 but with the announcement made, the second opinion won in the end.

Yes, there are more banks with quite a significant bond allocation. This is different from 2007-2009, when mortgage-backed securities were not as safe as the triple-A ratings showed they were. This is more a matter of customer trust. Nothing would have happened without the VCs calling their companies to withdraw money.

Which companies are affected? The list reads a bit like a who's who in tech. Etsy and Bill both use SVB for their transactions. Zoominfo, Snapchat and hundreds of other companies had SVB as an investor, although the positions are usually not that big. And then, of course, the companies with deposits at SVB.

Here are a few companies that have cash and equivalents at SVB:

Roku ($487 million, 26% of cash and equivalents), BlockFi ($227 million), Roblox ($150 million, less than 5% of cash and equivalents),, Shopify, Unity Software and many more. Most have smaller amounts. Lemonade, for example, disclosed it had $7,000 at SVB.

Roku has the most significant deposit at SVB, but this will not cause trouble for the company. The company filed its 8-K and clearly said it still has $1.4 billion at other banks. Besides that, Roku has no debt, so this will not be a big problem.

Yesterday, Secretary of the Treasury Janet Yellen, Federal Chair Jerome Powell, and FDIC Chairman Martin J. Gruenberg issued a joint statement. I include the most important quotes here.

Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today (...).

Finally, the Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.

In other words, the Fed steps in to fulfill one of its core tasks: to be the lender of last resort. All banks with trouble similar to those of SVB can make a loan that they can repay later. This should stop the panic.

There were also rumors that Silicon Valley's investment banking arm, SVB Securities, is exploring an acquisition of SVB. And there are all sorts of rumors now, of course.

In the end, the impact for Roku, and so many others will probably be minimal, even though it's a stressful period, of course. The problem for SVB was a trust issue, so the authorities will do everything to prevent new bank runs.

I hope this was interesting. If so, feel free to subscribe for more free updates.

In the meantime, keep growing!