Summary

Tomorrow, Wednesday, after the market closes, Shopify will release its Q4 2022 earnings.

In this article, we look at the key performance indicators for the company.

Why you should disregard Shopify's GAAP EPS and look at the non-GAAP result.

Shopify Payments and Shopify's app ecosystem are crucial for long-term success of an investment in Shopify.

Attach rate, which is not monitored by many individual investors, is a crucial metric.

Introduction

Tomorrow, Wednesday, Shopify will report its Q4 2022 results after the market has closed. In this article, I will show you what I will look at when the company releases its results. In that way, I want to give you some insight into how I analyze earnings. For each company, this is different and and this what I look at for Shopify.

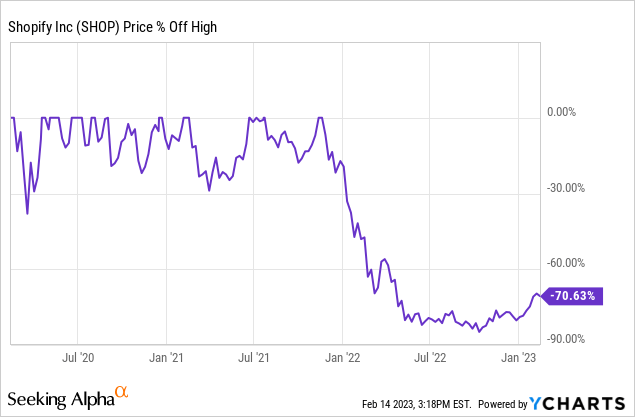

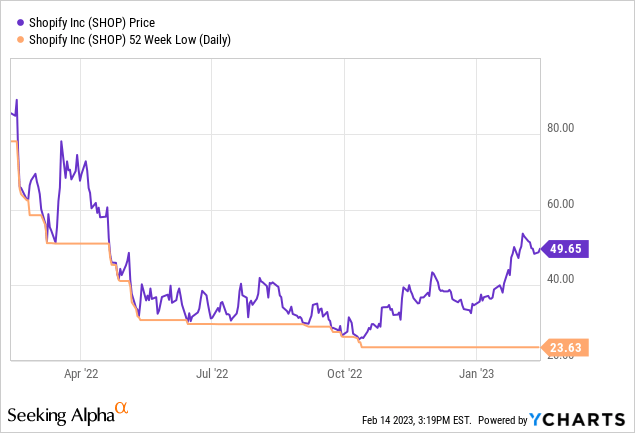

Shopify has experienced a very volatile period. Right now, the stock is still down 71% from its all-time high, but at the same time, it's already up more than 100% from its 52-low.

That also means that the upcoming earnings can cause another big move up or down.

The company is expected to have earnings per share of -$0.02. Revenue is expected to grow 19.5% year-over-year to $1.65 billion.

Let me show you what I will be paying close attention to.

1. Revenue growth

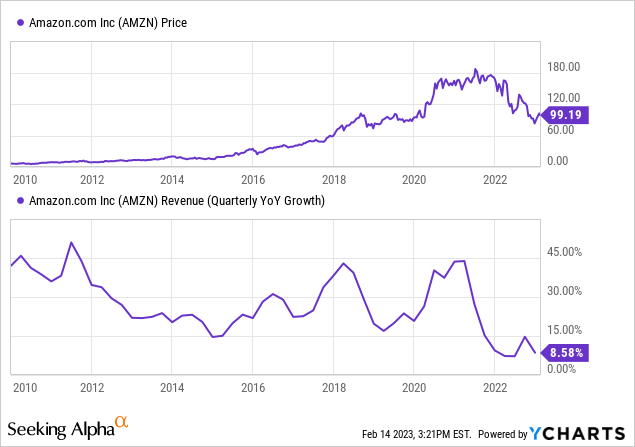

This may seem obvious for a growth company, which Shopify still clearly is. Some volatility in revenue growth is normal. Every company experiences it, even the best. This is Amazon's revenue growth from 2010 to now, for example.

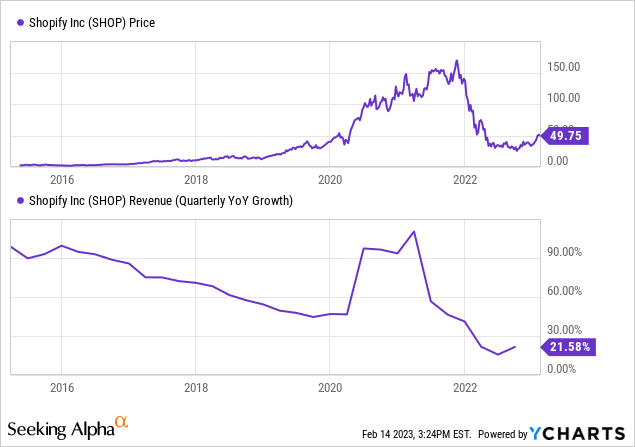

This is Shopify's chart from its IPO in 2015 to now.

Of course, that revenue growth slowdown doesn't look great, but it's normal that revenue growth slows down with size. If I had shown the previous decade for Amazon, you would have seen the same.

Before the pandemic, Shopify still grew its revenue in the mid to high forties. That the company is expected to grow less than 20% now may look like a red flag, but it's not to me. The reason is the very hard comparable quarters last year. As you can see on the graph, the pandemic injected steroids into Shopify's revenue growth, from the forties to 110% revenue growth in Q1 2021. That Shopify is still growing at 20% on top of the tough comps is a testament to its strength.

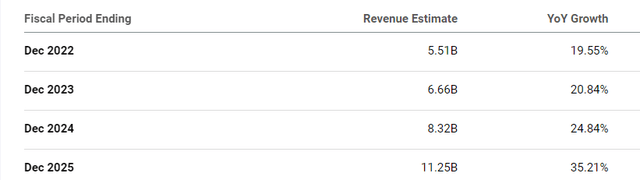

On top of that, analysts expect Shopify's revenue growth to pick up again in the next few years.

We shouldn't attach too much credibility to 2025 projections yet, but the point is that Shopify can continue to grow at 20%+ for many more years.

A beat on the consensus would be welcome for Shopify shareholders and show others that Shopify can be a valuable alternative to Amazon. Don't forget that Amazon disappointed in e-commerce, with sales down 2% year-over-year. If Shopify beats, that would be a sign of real strength. In this macroeconomic environment, this won't be easy, of course.

2. Earnings per share

This is mostly important for the short-term market movement of the stock. In the last quarter, Shopify's loss per share came in at -$0.02 per share, much better than the -$0.07 consensus. Now, the consensus stands at -$0.02, so if Shopify posts positive EPS, that could give the stock price another (temporary?) boost.

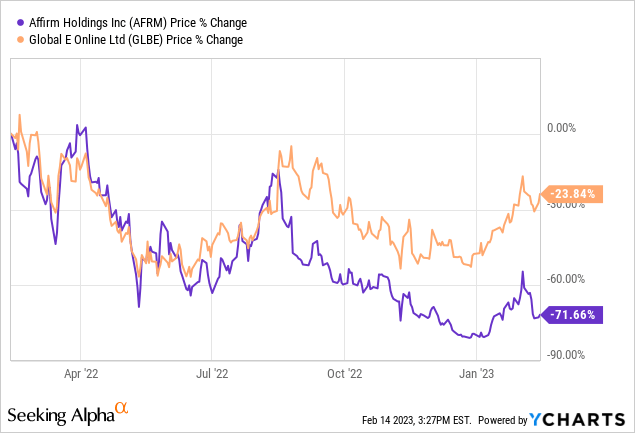

In general, you have to be careful with EPS. The number can be manipulated quite easily and there's usually noise. A clear example of noise is Shopify's investment in several companies, public and private. Some of the most well-known are Stripe (private), Affirm and Global-e. Stripe revised its valuation, and Affirm's and Global-e's stocks have plunged over the last year.

Under the GAAP rules, this has to be taken into account, even though Shopify has not lost any money, as it has not sold. So, don't look at the GAAP EPS numbers, the non-GAAP numbers represent reality much better.

3. GMV vs non-GMV

GMV is an acronym for gross merchandise volume or the total amount of money for everything sold on the stores Shopify powers.

GMV is important to show how sticky Shopify is, or, in other words, how much pricing power Shopify has. Judging from the last earnings, Shopify shows a strong value proposition for its merchants.

Revenue was up 22% year-over-year for Shopify in Q3 2022, while GMV was up only 11%, to $46.2 billion. This shows that Shopify could get double the revenue growth versus GMV. The reason was that merchants used more of Shopify's Merchant solutions, like Shopify Payments, Shopify Capital, and Shopify Markets. I want to see this trend continue, as this is very important for the long-term thesis for Shopify.

I want to make it clear that Shopify doesn't take a bigger part of GMV. Merchants use more and more of Shopify's solutions. That means this is a win-win. More accurately, it's a win-win-win, as next to merchants and Shopify, developers who sell their solutions on Shopify's App Store. On June 29, 2021, Shopify announced that it would have a 0% take rate for Shopify apps that have not grossed $1 million already and it also brought down the take rate for $1M+ apps from 20% to 15%, half of Apple's App Store or Google's Play Store. If Shopify turns out to be a great investment for the next 10 years+, app solutions will be a crucial element.

4. Shopify Payments

Shopify Payments is an important part of Shopify's business. Not just because Shop Pay is so intuitive and makes buying on Shopify as easy as on Amazon, but also because the company takes a percentage of payments. It has to share this with its payments partner Stripe, but still, this is easy money for Shopify.

In Q3, Gross Payments Volume or GPV came in at $25.0 billion, representing 54% of the total GMV. A year before, GPV was $20.5 billion, or 49% of GMV. As you can see, GPV was up in-line with revenue, by about 22%. I want Shopify to have at least 50% of GMV in GPV, and a really good result would be a growing percentage of GMV compared to the last quarter.

Amazon has recently rolled out Buy With Prime and Payments is the main reason Shopify has said to its merchants that using it is against the terms & conditions. Shopify's management has admitted that it's negotiating with Amazon about Buy With Prime. Amazon is known to be a tough negotiator, as you may know. If Amazon drops payments out of Buy With Prime, I think Shopify would be happy to allow it. After all, Amazon has a big reach and great fulfillment. For Amazon, there's still enough money to make on fulfillment and, especially, ads on its platform from Shopify customers.

5. Attach Rate

Attach Rate may need a bit more explanation. In general, attach rate is the extra product you sell with a product. For example, if a bike shop sells 50 bikes in a month and can sell 5 helmets with those bikes, the attach rate is 10%.

Shopify calls its merchant solutions revenue the attach rate. It's calculated as merchant solutions revenue divided by GMV. In Q3, Shopify's attach rate was 2.14%, the highest ever. Dropping under 2% would be a yellow flag, an early warning. Of course, there can always be a context, so we should listen to management, but the attach rate is very important for the investment thesis for Shopify.

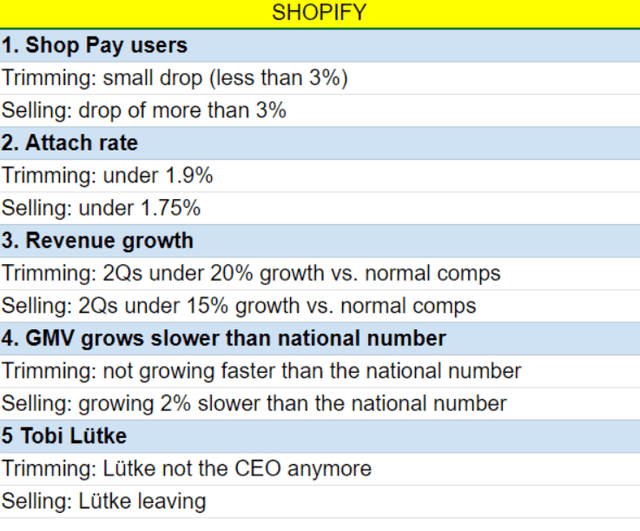

Selling Rules

These are some of the metrics I use to set up Selling Rules for my stocks. I'm a long-term investor, and short-term movements don't bother me too much. As my Seeking Alpha bio says, I think in decades rather than years, let alone months.

But you still need KPIs for a company, and I am rolling out Selling Rules for each of my picks. There's always a context that has to be looked at but some rules can help in staying disciplined. Normally, I will keep these for my Potential Multibaggers subscribers, but I will share the Selling Rules for Shopify here to give you an example of how you could make your own Seling Rules as a long-term investor.

I also follow these up closely every quarter and that gives you a quick and fast insight into the KPIs that really matter.

Of course, these Selling Rules can change over time, as the company evolves. In a previous article, I wrote about the five stages of profitability

From a company that is in stage 5, distributing money to shareholders, you should not expect 20% revenue growth. But Shopify, is of course not there yet.

In the meantime, keep growing!