RIP Charlie Munger

All I want to know is where I'm going to die, so I'll never go there.

Charlie Munger

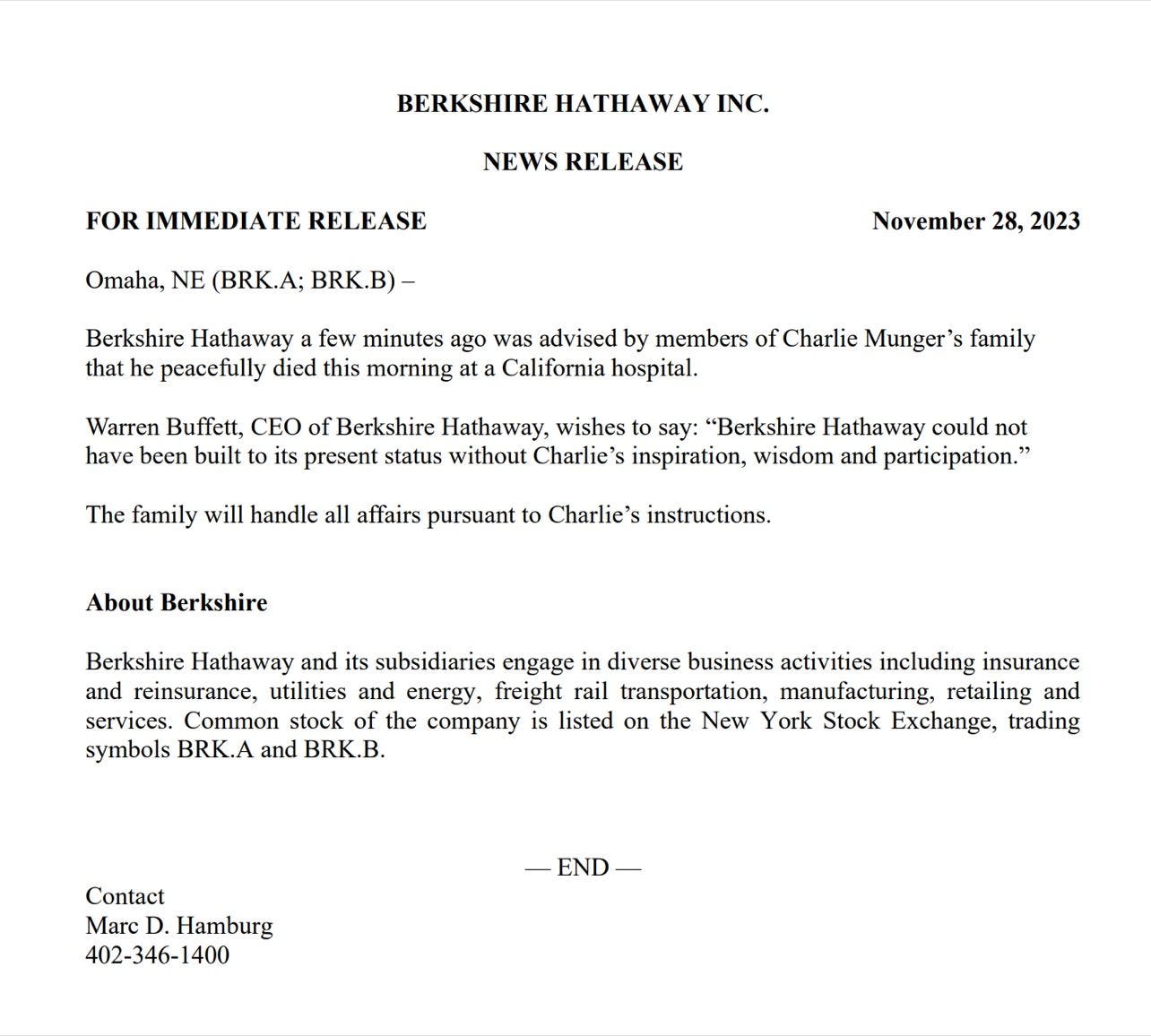

It's a sad day for investors today. Charlie Munger, one of the greatest investors of all time, passed away. This is the press release from Berkshire Hathaway.

Munger spread so much wisdom and that made hundreds of great quotes.

But I did want to spend some time on this one.

I spent a lifetime trying to avoid my own mental biases.

In his legendary speech at Stanford, Munger talked about psychological biases.

1. Reward and Punishment Super-Response Tendency: People are strongly motivated by incentives and punishments.

2. Liking/Loving Tendency: People tend to ignore faults of, and comply with, people and things they like.

3. Disliking/Hating Tendency: People also tend to ignore virtues and dislike people and things they dislike.

4. Doubt-Avoidance Tendency: People hate uncertainty and tend to quickly decide on an explanation for things.

5. Inconsistency-Avoidance Tendency: People are reluctant to change, particularly if it means admitting to a past error.

6. Curiosity Tendency: Natural curiosity pushes people to seek new information and knowledge.

7. Kantian Fairness Tendency: People have a natural tendency to want to treat others fairly and to expect fair treatment in return.

8. Envy/Jealousy Tendency: Envy and jealousy are powerful human motivators.

9. Reciprocation Tendency: People feel obliged to reciprocate both favors and disfavor.

10. Influence-from-Mere-Association Tendency: Associations can strongly influence human thinking and behavior.

11. Simple, Pain-Avoiding Psychological Denial: Denial is a common way to avoid pain, often by ignoring reality.

12. Excessive Self-Regard Tendency: People tend to overestimate their own abilities and preferences.

13. Over-Optimism Tendency: People tend to be overly optimistic about favorable outcomes.

14. Deprival-Superreaction Tendency: People often react with irrational intensity to the loss of something they already possess.

15. Social-Proof Tendency: People tend to follow the behavior of others, particularly in uncertain situations.

16. Contrast-Misreaction Tendency: Small differences can lead to irrational actions in human decision-making.

17. Stress-Influence Tendency: Stress can significantly alter human behavior and decision-making.

18. Availability-Misweighing Tendency: The availability of information heavily influences decisions and judgments.

19. Use-It-or-Lose-It Tendency: Skills and abilities can deteriorate if not regularly used.

20. Drug-Misinfluence Tendency: Drugs and alcohol can significantly affect human judgment.

21. Senescence-Misinfluence Tendency: Aging can impact decision-making and cognitive function.

22. Authority-Misinfluence Tendency: Authority figures can heavily sway individual decisions.

23. Twaddle Tendency: People are often attracted to meaningless statements and jargon.

24. Reason-Respecting Tendency: People are more likely to comply with requests given a reason.

25. Lollapalooza Tendency: Multiple biases acting together can create particularly strong distortions.

These biases provide a framework for understanding how people think and make decisions, and especially in investing, where understanding human behavior can be more important than crunching numbers.

I collected these in this visual.

Last week, I booked a plane flight and an Airbnb in Omaha, for my very first Berkshire Hathaway conference. It will probably be a very moving annual general meeting, the first without Charlie Munger, Warren Buffett's business partner, sidekick and friend.

Munger has been a mentor to many, including me. I have always loved his straightforwardness, his intelligence, his wit.

I think it's important to remember and celebrate Munger's wisdom. Munger's insights about investment and life are timeless. He was a passionate advocate for life-long learning. Of course, in Munger's own words, it sounds better:

If you’re going to live a long time, you have to keep learning. What you formerly knew is not enough. If you don’t adapt, you’re like a one-legged man in an ass-kicking contest.

That's how we can honor Charlie Munger, by learning from his wisdom, his clear thinking and his outspoken opinions. And, of course, his Mungerisms, which were so full of truth and always put things into perspective. Like this one, for example, one of my favorite Mungerisms:

If you mix raisins with turds, they are still turds.

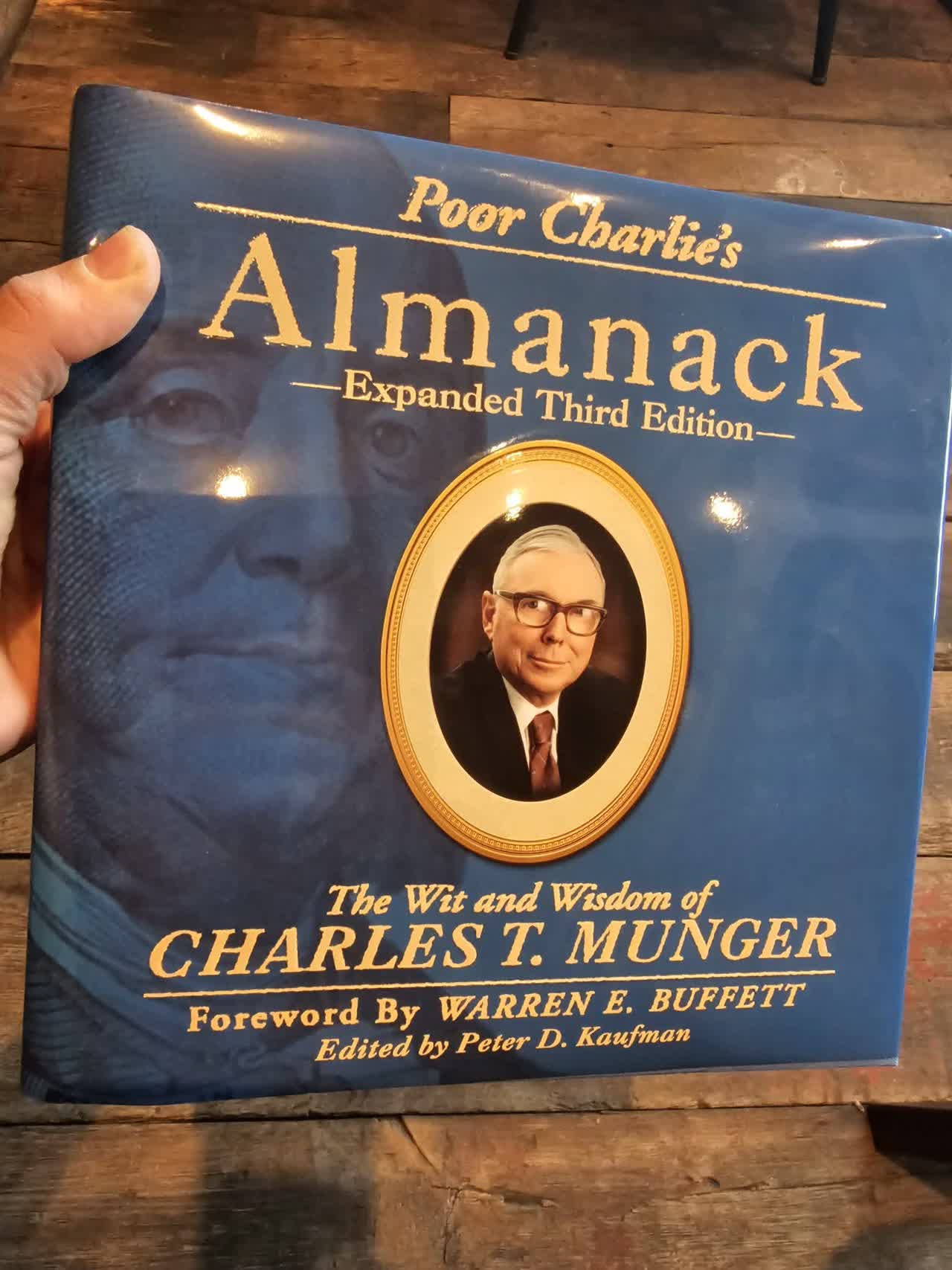

By continuing to learn, we can keep Munger's legacy alive. I will do that by continuing in the book I started ten days ago, Poor Charlie's Almanack, a collection of Charlie Munger's best talks, quotes and ideas.

Today, more than ever, keep growing!