Hi

I have not been very active here in the last weeks. I was away to Portugal for a weekend with fellow financial content creators and then I took some days off with my family. Taking off time can be great for new ideas and I got one that should benefit you all.

I will implement some changes soon.

First, in a few weeks, I will remove the paywall for all older articles. I will then refund the remaining money to those who have supported me by paying for older articles.

Secondly, on Potential Multibaggers, I have the Overview Of The Week each Sunday. From now on, I will share some tidbits from that OOTW every Monday for free. After a few more points, this will be the content for this article.

If you want the full option, you can go to Potential Multibaggers through this link. It will not only give you a 2-week free trial in which you can read everything for free (and you can unsubscribe with just a few clicks) but you will also get a 20% discount if you decide to stay.

Thirdly, I will launch the full service here as well. That means that if you don’t want to go to Seeking Alpha, you can also wait a bit and subscribe here. Of course, my full archive is on Potential Multibaggers (nearing 1,000 articles!).

I also want to point out that I have a partnership with Finchat now. To be honest, I was subscribed to almost a dozen services and I only use Finchat now. There is a generous free tier but you have a huge range of options with the Plus subscription for just $246.5 per year if you use this link.

That’s 1 Starbucks coffee a week (and you shouldn’t even take the fancy full-option frappuccino then). My time is precious and Finchat saves me hours per week. For example, I don’t have to look up KPIs in the filings anymore. Finchat has them for me. These are three KPI (key performance indicators), for example: the total paying customers, customers paying more than $100K per year and sales through channel partners (important for the rest of the article).

There are 9 other KPIs for Cloudflare alone, and more than 100K companies covered by Finchat have more than 20K KPIs. Of course, many are used for many companies (like “revenue from EMEA”, for example) but many others are unique for the company. And you can arrange everything yourself in the charts you make. I made the title, the fact that the three are apart and not on the same chart (which would also have been possible), the fact these are bar charts and so on.

I’m not even talking about the AI that makes Finchat even more unique. So, get that Plus subscription for just $246.5 per year with this link.

Boy, I really have to curb my enthusiasm about Finchat. That’s because it’s real, not fake. I have never partnered before with any service, even though I get weekly offers to do so. But this is the one that I’m genuinely enthusiastic and passionate about.

But enough now. Let’s go to the first tidbits from the Overview Of The Week, as I had promised. This week, I share news about Cloudflare and Nu. In the Overview Of The Week, I also shared news about Crowdstrike, Datadog, Duolingo, macro thoughts, thoughts about the market, the Meme Of The Week and much more.

Cloudflare Poaches A Palo Alto Veteran

This week, it was announced that Cloudflare (NET) hired former Palo Alto Networks (PANW) Channel Chief Tom Evans to help scale Cloudflare with its partners. Evans becomes the first-ever chief partner officer.

Tom Evans, Cloudflare's new chief partner officer.

In an interview, Evans said that:

I loved my time at Palo Alto. I had a great six and a half years there. And I think it's a true testament to what a great opportunity this is — to make me want to leave such a great company. I'm very proud of everything we did there and very proud of the team that we had built. This was an opportunity that I just could not pass up.

He added another reason, which I think is interesting because its says a lot about Cloudflare's company culture:

The mission — which everyone, to their credit, brought up in our conversations — is to help build a better internet. And that’s attractive to me, to go beyond what I've done before and really look at how many different aspects across the internet that Cloudflare touches.

Evans sees an opportunity I had emphasized before: the big growth in channel partners' revenue, which was up 174% in the last quarter. Recent hire Mark Anderson, now Cloudflare's CRO, focuses on this growth driver. Evans will also report directly to Mark Anderson. Don't forget that Anderson was the former CEO of Alteryx and, especially, the President of Palo Alto Networks.

In that sense, this is poaching a key employee from a competitor, as Cloudflare and Palo Alto compete more and more on SASE (secure access service edge) and SSE (security service edge).

Evans:

We’re going to look to tweak anything with the program that will help them or anything within our own internal processes that will make it easier to do business with us. I think they'll find that I'm very amenable to making changes to really drive the business.

Evans spent 6 and a half years at Palo Alto Network and before that a decade at F5, where he headed the channel sales for five years. And, look, that's another company Mark Anderson worked at. I think this makes it clear who's hiring this is.

Solution and service provider powerhouse Kyndryl has been a big partner for Cloudflare since their partnership started a year ago. Since the expansion of the partnership in March, Kyndryl has now been partnering with Cloudflare worldwide.

Kyndryl's Chris McReynolds, vice president for global offering management, edge compute and network, said:

We continue to see more successes, partly because of the broad appeal that Cloudflare has across different industry verticals.

On top of that, McReynolds is very positive about Cloudflare:

They're listening to our feedback incredibly well,” McReynolds said. “And they're not only listening to the feedback, but they're taking that feedback and really shifting their roadmap around so that we can enable a good joint experience for the customers we're serving.

I think this is an outstanding hire for Cloudflare. This is someone who knows how a mature sales organization looks like and he can build that at Cloudflare.

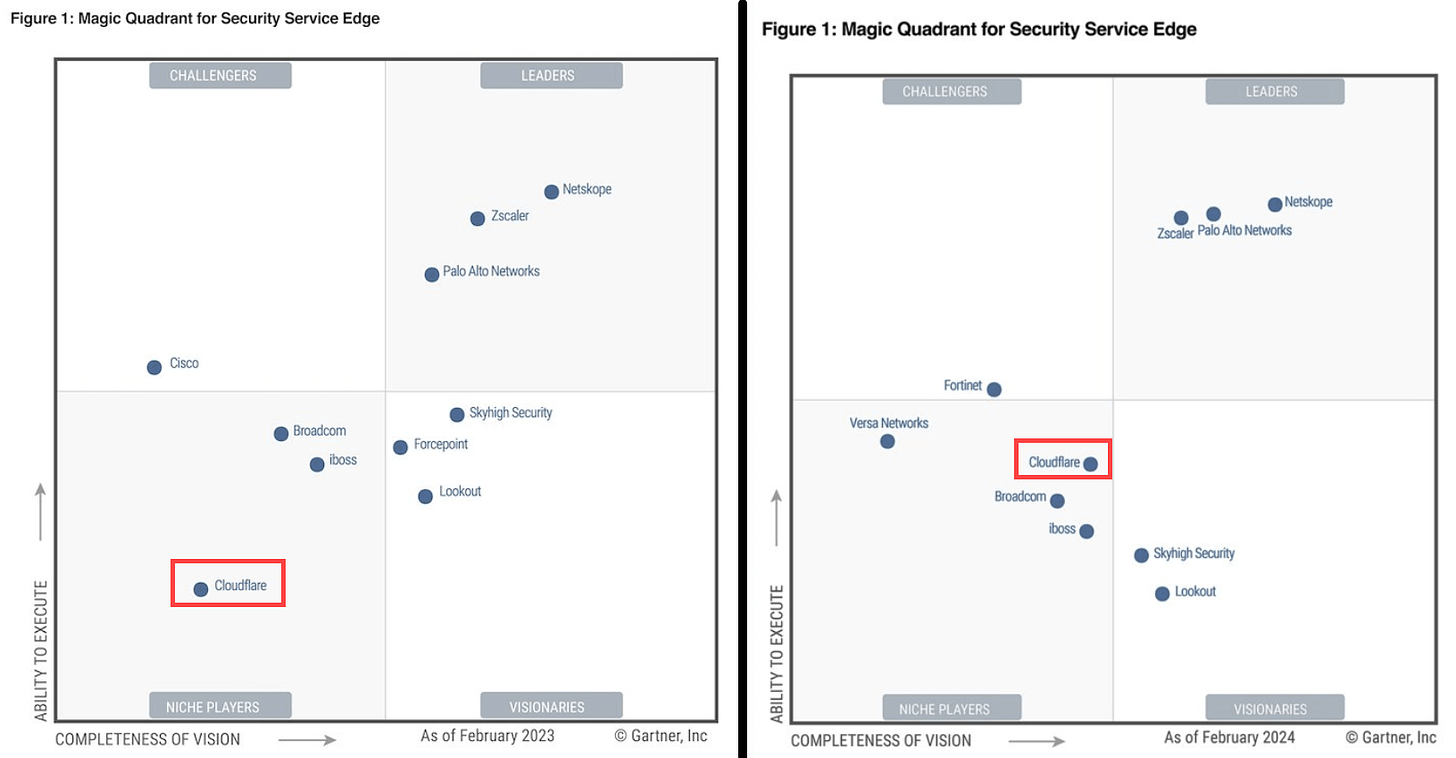

Cloudflare Moving Up In Gartner's SSE Magic Quadrant

Gartner just released its 2024 Magic Quadrant for SSE, security service edge. SSE integrates multiple security functions into a single platform, such as data protection, threat prevention, and access control. This simplifies cybersecurity a lot for businesses using the cloud and having remote workers.

Netskope remains the top leader. Palo Alto is now at the same level as Zscaler (ZS). But Cloudflare is also rising fast.

Cloudflare is a newer entrant, so it's normal it has some catching-up to do, but that goes fast. As Cloudflare has so many offerings, it's a competitive advantage that it can centralize several services in one central place.

Nu Will Invest More In Mexico

This week, Nubank (NU) announced that it will invest another $100 million in its operations in Mexico.

The additional money means Nubank’s total investments in the country now a total of more than US $1.4 billion.

Nubank co-founder Cristina Junqueira:

With this investment, Nu México reaffirms its position as the best capitalized financial institution in Mexico.

Nubank savings accounts were launched in Mexico not even a year ago, and within the first month alone, already more than 1 million accounts had been opened, representing 1 billion pesos (or $58 million) in deposits.

A second savings account, with an interest rate of 15% was launched a few months ago and it added another 1 million customers. Earlier, Nubank had become the second-largest credit cards

The company’s success in Mexico started when Nu México launched an international credit card with no yearly fee in 2020. By September 2021, the company was the second-largest issuer of credit cards in Mexico.

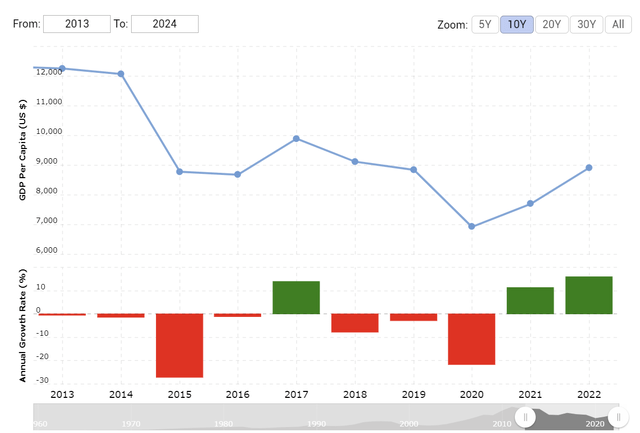

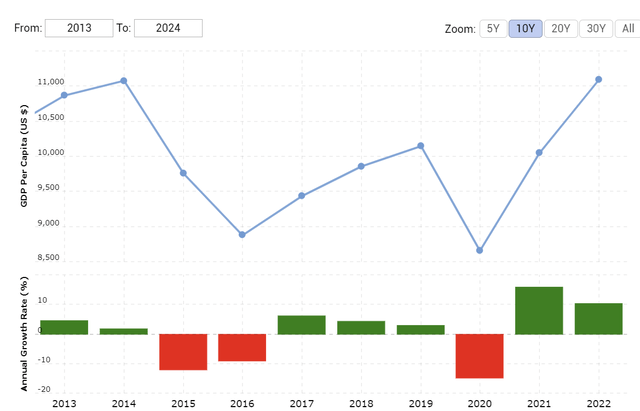

Mexico is a really interesting market for Nu. While its population is quite a bit smaller than Brazil's, the GDP per capita is substantially higher. That means the potential

As you can see, Mexico's population is 40% lower than Brazil's but the multiplication of the population and GDP per capita is only 22% lower.

On top of that, Brazil's GDP per capita has trended down in the last ten years, although since 2020, there seems to be a trend reversal.

Mexico had some tough years as well, but overall, GDP per capita is still up over the last decade.

Over time, I think Mexico will become as important a market for Nu as Brazil. Fede Sandler, the former Investor Relations Officer of Nu, said in exactly the same thing in the interview I had with him. You can expect that interview in the upcoming week. Yes, also for free, so don’t hesitate to hit the subscribe button if you haven’t already.

I hope you enjoyed this first-time sharing of a part of the Overview Of The Week.

In the meantime, keep growing!

Hi Kris, great that I (we) can also become a paying member of Potential Multibagger via Substack. Count me in! With pleasure I would like to accept your offer.

Hi Kris, Is this still coming?