Hi Friends!

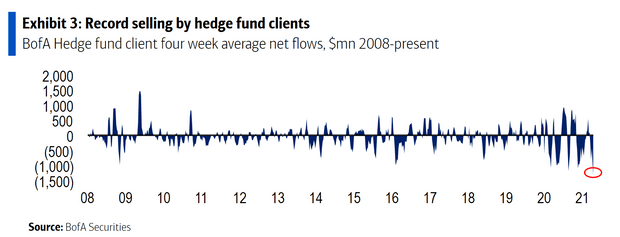

If you look at the inflow and outflow of money from hedge funds, you see that in 2021, more money was drawn out of the stock market since the recordings started in 2008. That's almost unbelievable, as the circumstances were not that bad.

(Source)

As individual investors, we are often the prey of hedge funds. They want us to do the opposite of what they do to scrape off the money. And with a huge majority of individual investors, that works perfectly.

Let's look at Joe and Jane Investor, for example. They hear about inflation, rising interest rates, and job numbers, and it all sounds frightening, especially in combination with a plummeting stock price.

A lot of individual investors keep their stocks at the start of the drop, thinking that it will go away soon. When it doesn't, they want to know why their portfolio is down. They read some headlines, watch CNBC or find stock market groups on Facebook. All of these sources tell them the same thing: DANGER!

So, when their portfolio is down 15% or so, they sell quite a few positions. It hurts but they think that they will buy in later when the stock is down more. And the stock continues its dive to 25%. The average Joe and Jane Investor are really happy with themselves that they could avoid that extra drop from 15% to 25%.

Then the market starts to turn and it's at -18% now, and our Investors want to know what to do. They seek out information and that information is really depressing. Most people agree that the market or the sector or a stock will continue to drop. And indeed, they are right, it drops to -25% again. Jane and Joe are so happy with themselves! They avoided the bull trap.

This happens a few times, until the stock market/ the sector goes up 5% two days in a row and all of a sudden, it's -8%. Jane and Joe think of buying back but everyone agrees that this is another bull trap. Inflation, you know, or interest rates, or a trade war with China, the war in Ukraine or the Middle East, the elections or what have you. Doubt. Eventually, Jane and Joe buy back at -3%. As they previously sold at -15%, they have lost 12% in just a few months. The next time won't be different.

The study about Joe and Jane Investor

Do you think this is exaggerated? Maybe a bit. But every year since 1984, there has been a Dalbar study about stock market returns. This is how it states its purpose:

Since 1984, independent investment research firm Dalbar Inc. has published its annual Quantitative Analysis of Investor Behavior report, or QAIB.

This research series studies investor performance in mutual funds. Its goal is to shed light on how investors can improve portfolio performances by managing behaviors that cause them to act imprudently.

In every single year since 1984, all of them, the average individual investor underperforms the market index. This is why:

If you've been following Dalbar's research over the years, you're well aware that one consistent theme keeps cropping up. Namely, the set of longer-term data analyzed in these QAIB reports clearly shows that people are more often than not their own worst enemies when it comes to investing.

Often succumbing to short-term strategies such as market timing or performance chasing, many investors show a lack of knowledge and/or ability to exercise the necessary discipline to capture the benefits markets can provide over longer time horizons. In short, they too frequently wind up reacting to market maturations and lowering their longer-term returns.

(...)

Each year, the study concludes that the minority of investors who remained patient and did not focus on short-term issues and market volatility were much more successful than those who act on their emotions rather than investing for the long term.

That also means that hedge funds know this and will play with it. If they cause growth stocks to drop by drawing out money and putting it in value stocks or cryptocurrencies, retail investors will follow them to those assets. Once a majority is in, that takes a few months, they take the other side again. Again retail investors follow them and the play goes on and on and on.

Stepping out of this stupid game will change your investing forever. It may take a deliberate and difficult decision not to sell, not to follow your emotions and it will remain difficult but just have some patience.

This is Q4 2018, for example, when the Nasdaq fell almost 25%.

The drop was called the SaaScopalypse because many SaaS stocks (Software-as-a-Service) were down much more, a lot them 50% or more.

Of course, the bears came out of their holes, slamming down SaaS investors, rejoicing that those "crazily overvalued" stocks crashed. Analysts said exactly the same thing but in slightly more business-like language. It was a 'sector rotation' away from 'overvalued hype stocks'.

After the SaaScopalypse quarter, this is what has happened with the Nasdaq since the SaaScopalypse, now 5 years ago.

Up 185% or a CAGR (compound annual growth rate) of 23.3%. Not bad at all, despite all the drama of the Covid crash and the 2022 crash.

Of course, you could say, with reason, that I picked the bottom. But what if you just had held your positions from before the SaaScopalypse? This is from January 1, 2018.

As you can see, the SaaScopalypse made that you were in the red at the end of 2018. But overall, the Nasdaq is up 163%, or a CAGR of 17.5%. Not too shabby for doing nothing, right? Of course, it’s less than picking the absolute bottom, but that is just impossible in real life. With 163%, you will have done much better than Jane & Joe Investor, that’s for sure. Don’t forget that they would have performed their same trick in March 2020 and in 2022.

But what if you invested at the worst moment, just before the SaaScopalypse?

Up 119%, not bad for investing in “crazily overvalued” stocks. If you had started investing in September 2018, you could have been down 35% or 40% in your portfolio in a matter of a few months but you would have great returns nonetheless. That's what you should keep in mind all of the time.

Yes, it feels scary sometimes, but trust the studies: acting in a rational way and following the process will make you outperform the index, not underperform it like almost all other individual investors.

Conclusion

98% of everything you hear about the stock market is what you shouldn't focus on: short-term noise.

I just stay the course and focus on fundamentals because I know that if I stay invested for 5 years (and preferably longer, of course), I have a very high chance of getting outstanding returns, mostly a lot better than a huge majority of people who jump in and out of positions. Adding money regularly and scaling in slowly is a great way to deal with the situation.

In the meantime, keep growing!