Summary

If you have a cash pile, should you wait for the crash to invest, just invest it right now or dollar-cost average?

Theory and real life are different and human psychology is very imporant.

We look at the results of three approaches: market timing, dollar-cost averaging or lump-sum investing

I explain what dollar-cost averaging on steroids is

Even if you are retired and no money comes in, you could practice some form of dollar-cost averaging if there is a crash.

Hi

One of the questions I regularly get is: “how should I invest a lump sum that I got from a bonus, the sale of a house that got too big, your company got bought out or you got a big sum from parents as a gift or from an inheritance?”Or you want to change from owning a fund to individual stocks.

The circumstances can differ, but the situation is the same: you have a lump sum of cash, and want to invest it. But the question is how do you do that exactly? That's what this article will focus on.

The Problem

A lot of investors are afraid of the markets. That's not surprising: except for specialized business media (sometimes), you only hear about the stock market in the news when there is a big drop or a crash. That influences the perception of how you look at the stock market.

The problem for people with a large sum to invest is that they are afraid they will invest their money just before a crash, annihilating the sum. Even now, when the Nasdaq is still more than 20% under its all-time high, people are afraid of the crash that always seems to be near.

Especially when a lot of people shout that the market is 'fully valued', has 'extended valuations' or is 'ridiculously overvalued', inexperienced (and most experienced) investors are afraid that it's not the right time to investe. In other words, they want to time the market.

The problem is that there are always people calling the market overvalued and if there aren't many, that’s when you should be terrified because then the overvaluation and euphoria are probably extreme.

But many investors sit on cash for much too long, 'waiting for the crash' that may never come or at least not as they expect. And when it eventually comes, it feels so scary that they don't dare to invest the money as well, expecting the market to drop further. At the end of the day, they miss a ton of money they could have made.

There are basically three options to invest the lump sum. The first option is that you just invest the whole sum immediately, the second is the one I already mentioned: waiting for the market to drop and then investing everything, the third is dollar-cost averaging, so investing the same amount of money periodically.

The theoretical answer

The theoretical answer to the question of how to invest a big pile of cash is quite simple: you should invest all of that money right away.

Vanguard conducted a study several years ago in which it compared lump-sum investing and dollar-cost averaging. There are two scenarios: you invest the money right away and wait or you dollar-cost average that money over one year, the same amount each month.

The study found that the lump sum was the theoretically best thing to do. Historically, in 65% of the moments, that's 2/3 of the time, a lump sum investment outperforms dollar-cost averaging. The difference was about 2.39% but the longer you hold, the higher the outperformance.

The main reason is that most of the time markets go up and the sooner you get exposure to that, the more you'll outperform.

Of course, there is a much bigger difference between the highest and lowest return of the lump-sum investing (LSI from now on) than in dollar-cost investing (DCA from now on). Or in other words, the risk that you lost considerably more was higher with LSI. Averages don't prove everything and a river that is statistically only a foot deep can be dangerously deep at certain points.

So, the potential losses for LSI are much bigger than for those of DCA. That's why I prefer DCA. But before we go into that, let's check the third option we haven't considered yet: buying the dip.

Suppose you have a perfect crystal ball: it gives you every single bottom of every single dip and that's when you buy. Then you start hoarding cash again until the next dip. At the exact bottom of the next dip, you invest all of it and then start hoarding cash again and so on.

You probably think that this is the best strategy, right? Because so much emphasis is placed on timing the market in the financial media, you expect this unrealistic (no one can predict the bottom) but very attractive model to beat DCA and LSI by a wide margin. But it doesn't. Even with perfect foresight, you'll underperform DCA. This is the result from 1920 to 1980:

As you can see, only in the period of the Big Depression, the BTD approach did better than the DCA way.

If from this post you only remember one thing, although I hope there will be more, let it be that waiting to invest your money to buy the dip is the worst investment strategy there is. A lot of times, the dip is higher than when you could have invested the money. And besides that: how are you going to buy the dip? Timing the bottom is nearly impossible to do. And even if you could, you'd lose to DCA.

Why I dollar-cost average

For me, the situation is clear: I practice DCA or dollar-cost averaging. I add the same amount of money to my investing account every two weeks. With the money that comes in, I invest immediately, which means that I'm almost always fully invested. I don't wait to invest my money in a dip.

As I said, the losses of LSI are often much bigger than those of DCA, although the winning is bigger too. But with just a bit of outperformance, you can not heal the pain of the loss potential. As humans, we all have loss aversion. The pain from loss is felt much more than the pleasure from pain.

(Source)

With DCA, you can reduce the pain substantially while the gain is not severely impaired. So, it's psychologically easier to DCA.

Of course, the right long-term approach is also important. If you have a time horizon of 10 years or more, why would you worry about a temporary and theoretical loss of money when you know that you can concentrate on winning?

It may not be the right time now because I know many investors are in pain, but I’ll put it out anyway: If you DCA, a crash is great, as I'll show.

The Power Of DCA

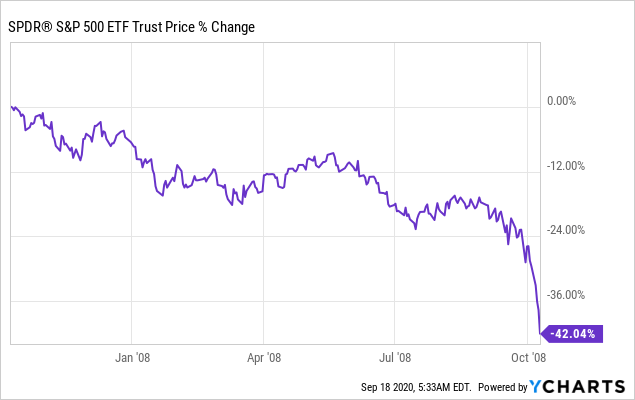

DCA is a perfect market crash hedge. Look at the Great Recession, the huge stock market crash of 2007-2009. Just to give you some context first, this is what the S&P 500 (SPY) did back then:

That means that if you invested $10,000 on October 11, 2007, you would only have $4,381 in your account in March 2009. It would take until mid-March of 2013 before you would have that $10,000 in your account again. That's 5.5 years of losing money in the stock market, and that's not what you want to see.

If you invested that same $10,000 on that worst possible date, October 11, 2007, but then you had DCA'ed $500 each month after that, you have a completely different picture. After three years, you'd be in the green again, with a CAGR of 1.15%. Nothing to pop champagne for, but in the worst market since 1929, that's a great result.

But let's take it a step back further. Suppose you didn't invest that $10,000 in one go on October 11, 2007, but you had dollar-cost averaged it over the course of a year, together with your monthly contributions of $500. That would mean a monthly investment of $1250 over the course of 1 year ($750 of the $9000 left divided by 12 and $500 from your monthly investments).

After one year, you would be down 7.4%. The market would already have dropped by 42% over that period:

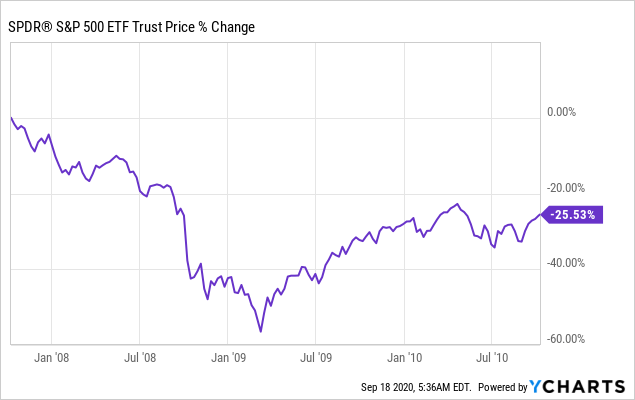

But we have 2 more extra years to go, as we invest for at least three years. This is the result for the general market for the 3-year period from October 2007 to October 2010:

And this is the result after dividing your lump sum of $10,000 over 12 months and adding $500 to your account every month for 3 years:

(source: dqydj.com)

After three of the worst years ever to invest in the stock market, and with the LSI still down 25%, the DCA method would have made you 14.41% annualized. That's better than the long-term average of the stock market.

And suppose, further, that you continued to add that $500 until mid-March of 2013 when the lump sum investor would finally have reached his break-even point, what would you have then? This is the answer:

After 5.5 years in which the lump-sum investor would have 0% returns, you'd have a return of 14.28% annually as a DCA investor.

I think this example shows why I don’t use stop losses, hedges or complicated financial products to protect my portfolio during a crash. Simple dollar-cost averaging is enough for me.

And yes, I know that this moment was cherry-picked, as it’s the moment a crash started. But that’s what many are afraid about right now: that a crash will start any minute. This shows what happens if the crash indeed would start. It’s a great moment to start investing, even if you already deployed a bit of money too early.

DCA with a lump sum

The example above already showed how I would invest a lump sum. Suppose you get a yearly bonus; why not split it up in 12 and invest it every month until the next bonus comes in?

Or if you have sold your company and you have a big pile of cash, why not decide over how many years you would want to invest that? You could take maybe five years and invest the same amount every month or every fortnight. You could leave the rest in cash, bonds or money market funds.

For example, suppose you have $500k; you could invest $100K every year or $4,000 every fortnight, for example.

As you see, there are a lot of nuances and you should definitely choose the one which suits you best. I always emphasize to subscribers of Potential Multibaggers that your portfolio should reflect your personality and therefore, you should also scale the lump sum into the market according to how you are and feel. If you are more conservative, you could add some bonds to park your money while you scale in.

DCA on steroids

You could also give this approach a shot in the arm by practicing what I call DCA on steroids. It's DCA but with a twist.

The best time to invest is in a market crash. That's why you could try to invest more money then. Suppose you are in the process of DCA'ing a lump sum into the market and it drops; then you could add more money to boost your returns.

If the S&P 500 drops by 10%, you could add 50% extra money to your normal capital injection. If it drops by 20%, you could double the money that you normally invest, a 30% fall means tripling the money and so on.

So, if you normally DCA $1000 each month, you could invest $1500 if the market has dropped 10%, $2000 if the market drops by 20%, $3000 if the market drops by 30% and so on. You pull forward the DCA of the next months and you invest the lump sum faster. Maybe instead of 5 years, just 2 or even 1, depending on the circumstances and your personality.

If you don't have a lump sum to take the money from, you could add a bit extra money too, if possible. Each month, I set aside money in an emergency fund. It has expenses for about eight months now. I decrease my contribution to the emergency fund when the market drops by 10%, and invest more money in the market. My dollar-cost averaging on steroids has been active for more than a year now and continues up to today.

What if you are retired and you can't DCA?

Maybe you are retired, which means that no money comes in to contribute each month to dollar-cost average and you take out money from your account. In that case, you could allocate a part of your portfolio to bonds. The traditional division is 60/40 (60% stocks, 40% bonds). I would use the bonds to live off if the stock market crashed and to invest in a crash. In other words, in a crash, I would allocate more than 60% to stocks. Once the market goes up again, you could go back to 60%/40% or even more bonds.

You could take a portion in short-term treasury bonds, which now yield over 5%.

It's an ideal moment to sell some bonds and invest the money into stocks. You could bring your bond allocation down to maybe 5% or 10% or 20%, as you see fit. Later, when you have the feeling that stocks have appreciated a lot, you could allocate a bit of money to bonds again. It all depends on your own personal circumstances, of course.

Conclusion

If you want to invest a lump sum, the theoretically best thing to do is to invest it all at once. But the downside is that the stock market could drop just after you have invested and it could take a while before you are back at the original level.

If you dollar-cost average, you lose a bit of outperformance on average, but you protect your downside much better. The longer you DCA, the better and with DCA, a crash is your friend, not your enemy, especially if you DCA on steroids.

In the meantime, keep growing!

Great read! I totally get the DCA approach when it comes to index funds investing. However, I am wondering how do you approach this when investing in individual stocks? Are you buying fractional shares, meaning you invest the same amount into all your holdings every 2 weeks?