Hi friends!

Paying members of Potential Multibaggers get very regular updates about the stocks we have picked. And I do that very systematically. Of course, the earnings are analyzed in all detail, but there’s more.

I have developed a few scoring systems to look at the quality of a business and how attractive a stock is to buy right now. Let me introduce you to the PMQS, the QPI score & the BHS scale.

First, what do these abbreviations stand for?

PMQS means Potential Multibaggers Quality Score. It’s essential to understand that it’s not just QS, quality score, but PMQS. What I mean is that stocks are not just scored on their overall quality but also on their potential to multibag. I think nobody questions the quality of Apple (AAPL) and it would score very well on several parameters (like financial stability, for example) but poorly on others (multibagger potential and revenue growth, among others) and overall, its PMQS would be rather mediocre. I focus on multibaggers, though, and that’s when you have to score for multibaggers, not only for quality, which remains a very important part of the equation as well.

I introduced the PMQS in 2022 when I saw that I had been deceived by some sweet-talking CEOs who knew what I (and other growth-oriented investors) wanted to hear. But it was just that, talk. The PMQS looks at all the granular details to see if the numbers match the talk. To put it differently, the PMQS should help me avoid losers like Twilio, Peloton, Teladoc, DocuSign and Stem. It was the PMQS that showed me clearly I had to sell these stocks and I did. At small or big losses, for sure, but all have either crashed a ton more (Stem, Teladoc, Peloton) or have gone nowhere since (Twilio, DocuSign).

Okay, so with the PMQS, you know how good a stock's quality is and how much potential it has to multibag, but how attractive is it to buy right now? That depends on the valuation, of course, and that’s where the QPI comes in.

QPI stands for Quality-Price Index. The name already suggests it: with the QPI score, I balance quality and price. The reasoning is that higher quality often deserves a higher price and lower quality a lower price and if you bring those two together, quality and valuation, you get a better idea if a stock is attractive to buy now or not.

How I do this is simple: I score the valuation out of 10, divide the PMQS by 10 and then add them up. I rank the scores of all my picks and that’s how I can see which are most attractive to add to. On top of that, I follow up the price of the stocks. If there’s a 20% move up or down, I update the valuation to see if the stock has become more or less attractive with the price movement.

The BHS scale is then simply a visual representation of how I see a stock based on the QPI. BHS simply stands for buy, hold, sell. But I don’t want to simply tag these terms, I put them on a scale to not oversimplify things. Often, it’s something between two things.

Alright, so far for the theory. I’ll show you how I do this in practice with Paycom right after this.

If you want the scores of all my other picks, you can use this link for Potential Multibaggers. It gives you a 2-week free trial and a 20% discount if you decide to stay.

If you don’t want to miss these free updates, don’t forget to subscribe to Multibagger Nuggets.

Personal conviction 7/10

Lowered from 8/10 in June 2024

This is mainly my or your own conviction based on everything I/you know about the company. Your own conviction may be very different here and you can adapt this score to your own liking.

You can download the sheet here to give your own score. If you want, you can do this alongside me.

For a long time, Paycom was a fuss-free company. It would quietly execute with minimal noise, and the market would reward it. Sure, there were drawdowns—there always are—but Paycom would always come back to make new all-time highs.

If you looked at a long-term chart of PAYC from its IPO in April 2014 to its peak in October 2021, you were looking at a 3,240% cumulative return, compared to only 144.5% for IVV, representing the S&P 500.

A company that was great for almost a decade doesn’t suddenly become a dud overnight; hence, my personal conviction was a 9.

Of course, from that October 2021 peak to now, the stock is down 74%, which would test anyone’s convictions.

Ironically enough, the two-year anniversary of that all-time high, October 30, 2023, was also the day the stock famously fell 38.5% in one day. Go figure.

So after a truly wild 18 months, is the stock still worth it?

A quote from the Q3 2023 earnings analysis I wrote:

Without being spectacular, Paycom always executed very well. Even during the pandemic, when a record number of people were laid off, the company kept growing its revenue, albeit at a much lower pace. I could go on and you would see that Paycom is an emblem of reliability.

At the same time, we know that Paycom is attempting a huge shift in its business by cannibalizing its own revenue in favor of Beti, a self-serving platform that it hopes will be the future of HR administration.

We know this will take time, and we mainly have to trust management. They have shown to be very reliable in the past, but the past is not always the same as the future, as we all know. That's why I reduced my personal conviction from 8 to 7, also because the communication around the transition could have been better.

The new co-CEO, who was brought in in February, was already let go, and Chad Richison is the only CEO again. As I wrote in the Overview Of The Week for my paying subscribers, the Multis:

Chris Thomas was Paycom's former Chief Operating Officer, and was only promoted to co-CEO on February 7, so less than 4 months ago. Usually, that's not well-received by investors. At the same time, I think that this is the best thing to do if something doesn't work. I have seen many companies keep the new leaders for way too long. Founder and President Chad Richison will now lead the company again as the sole CEO.

Paycom remains a “show-me” story and anyone who has worked in a business environment like this knows that it's way too early to judge.

Profitability 9/10

Reduced from 9.5 in June 2024

This remains one of the most profitable companies in the Potential Multibaggers universe. But I reduce Karan's score by half a point because of the non-GAAP metrics that Seeking Alpha uses. If we look at the GAAP metrics, we see this.

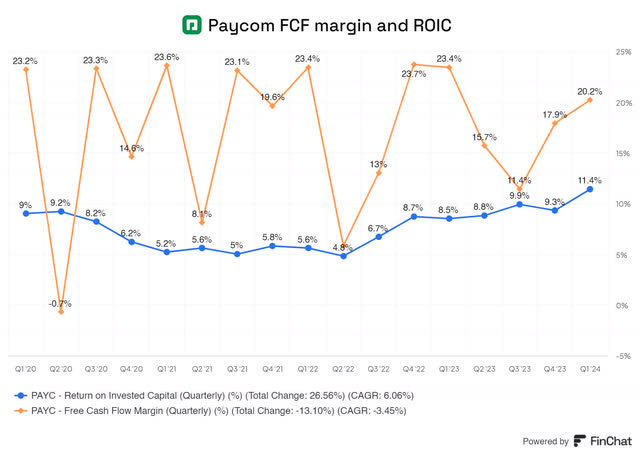

(A Finchat.io chart, if you click, you get a 15% discount if you take a subscription).

The market expects that margins will get worse because Beti is cannibalizing Paycom's legacy business. But so far, we only see the numbers going up.

Sales Efficiency 4/10

Decreased June 2024

The sales efficiency formula first looks at S&M (sales and marketing) as a % of revenue. Then I look at growth this year and the expected growth next year and I take the average. That is divided by the S&M number. That gives me the marketing efficiency. If you add gross margins then and you multiply, you get the efficiency score. That number divided by 10 is the score for this item. Here you see the score.

Paycom's gross margins remain very high, and even went up to 87.3%, but because of the substantial investment in sales and marketing (23.5%) and the lower revenue growth (10.6%) and expected revenue growth (10.5%), sales efficiency loses another point.

Innovation 4/5

Unchanged since June 2022

Paycom continues to improve its offerings. Honestly, for such a boring business, they spend a lot of time on improving their products. We are not comparing Paycom to Shopify, Crowdstrike or Cloudflare here, but in their own industry, with BETI and GONE, they have shown they are not afraid to push the limits when it comes to innovation.

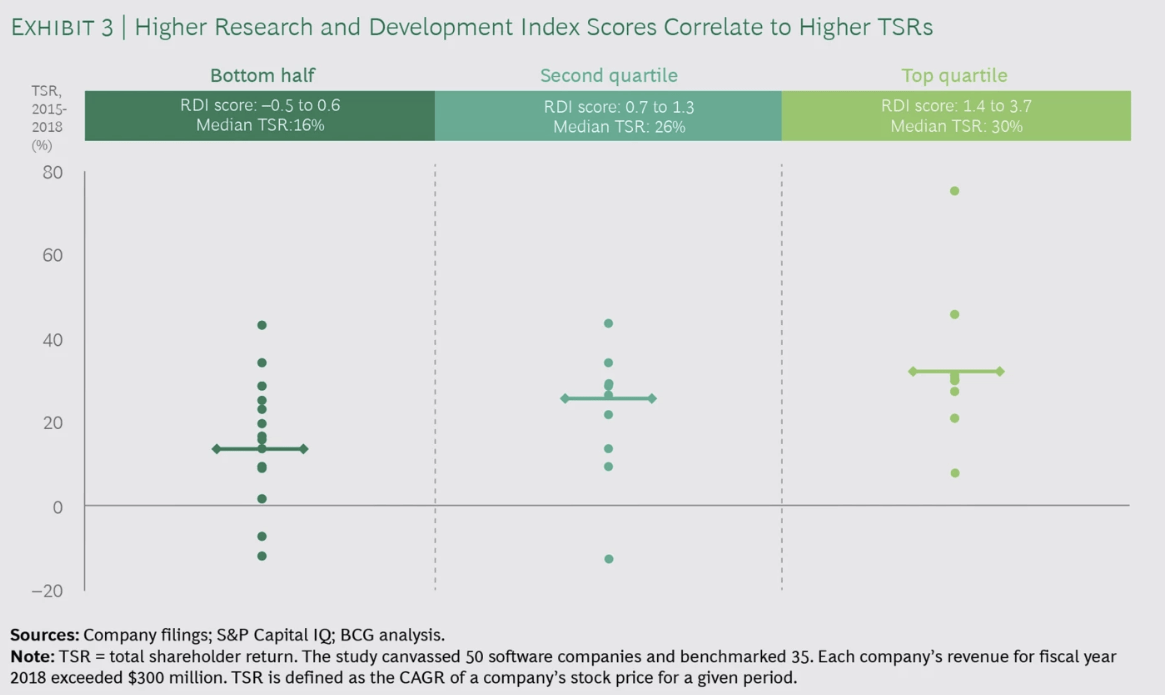

Paycom spent 10.44% of its revenue on R&D in the most recent quarter.

With sales growth of 10.6%, this means an R&D efficiency score of 1.02, not the highest you will see but still in the second quartile. These numbers are from 2015-2018, when the economy was doing great, so I guess Paycom could be in the top quartile now.

This is a macro-sensitive company, and yet it is still generating enough cash to improve the platform and reward stockholders through buybacks and dividends.

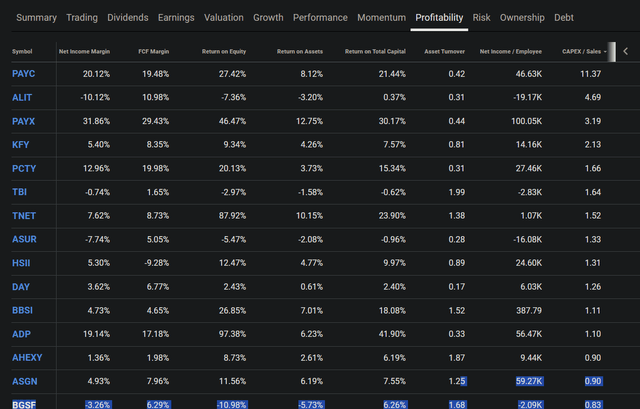

One final note on this, sorting the list of Paycom's competitors by CAPEX/Sales, this is what we see:

No contest, I consider this an innovative company in it’s industry.

Must-have? 4/5

Last changed: November 2023

Paycom's retention was 90% in 2023, down slightly from 91% in 2022. Attrition mostly came from small companies, while Paycom continues to grow with mid-sized firms. We don’t know if those smaller customers found cheaper solutions or went out of business, but whenever you doubt the stickiness of payroll software, remember Workday is a $66 billion company with EBITDA margins of 6% vs. almost 30% for Paycom, which is less than a sixth of the size.

As such, I maintain this at 4/5. No company can function without payroll, and while Paycom has seen some minor attrition, we would expect that in a slowing economy.

TAM & SAM: 4/5

TAM stands for total addressable market and SAM for serviceable addressable market, the market you serve because of your specific product and geographical limitations.

The global HR payroll software market is expected to reach $61.88 billion by 2028, with a compound annual growth rate ('CAGR') of 10.60% between 2021 and 2028. The global payroll and HR solutions market is expected to reach $50.4 billion by 2030, with a CAGR of at least 8.4%.

So says a research report I googled: TAM for global payroll software.

Without commenting on efficacy, given that Paycom's revenue is barely $1.7 billion, I will give it a 4/5 on opportunities.

Revenue growth 2/5

Last Changed: June 2024

This score rewards companies with higher growth and punishes those with slower growth. As such, Paycom again deserves a deduction here for trailing year-over-year growth slowing to 10.6%. The forward growth expectations are about the same. .

If this goes up, so will the score. 10% and 2/5 may seem harsh but I still want to look at what I really want from Potential Multibaggers. Make no mistake, though, even with 10%, a dividend and a buyback program, with some expansion of the multiple, you could see good returns from this price right now (around $140).

Revenue growth durability 7/10

Last Change: June 2024

This is a binary outcome based on how BETI does and that's why I lower the score. Chad Richison thinks Beti will help Paycom to retain more customers, but we still have to see that play out. The uncertain part is not Paycom growing but the revenue re-acceleration.

Management Quality Score 8.5/10

Last change: June 2022

The co-CEO is gone in just a few months, and that means that we can stay with this score, as we know how well Richison has done in the past.

Insiders' Ownership 5/5

Updated April 2024

Previously I wrote this:

“For Paycom, we see high ownership too, for Chad Richison: 13.9%.”

However, this included 1.6 million shares awarded to Chad Richison as part of a 2020 Award. Due to the poor performance of the stock, Richison forfeited these shares, so his actual ownership stake is 11.6%. Not that it makes too much of a difference since he hasn’t sold any shares but updating for the sake of accuracy.

Multibagger Potential Now 2.5/5

Decreased June 2024

I am not that optimistic that Paycom can go multiply but at the same time, Paycom has only just begun to compete internationally and is actively buying back shares. Anything is possible if BETI succeeds both in the US and abroad. But that's a big IF. That's why I reduce the score to 2.5. If Paycom executes well with Beti, it could be a multibagger.

Financial Strength 9/10

Last change: June 2022

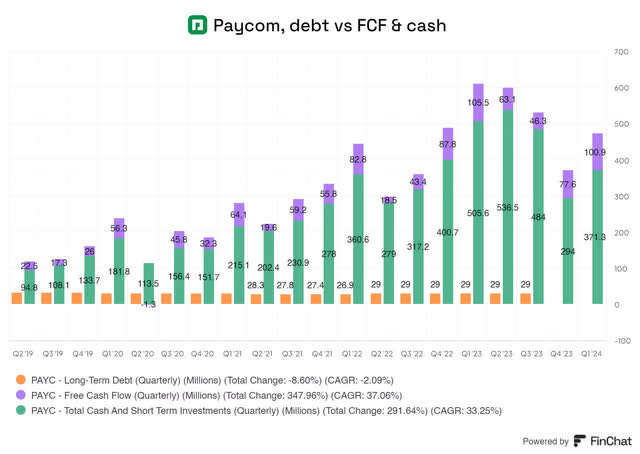

Keeping this simple, net cash and immensely profitable, Paycom can survive a downturn in the economy and with Annual Free Cash Flow continuing to grow (almost equivalent to their total cash), they have plenty of cushion to survive.

As you can see from this Finchat chart, the company is debt-free, has a substantial cash reserve it uses to buy back shares and generates free cash flow on top of that.

I would not give this a 10 given the industry and macro-sensitivity of the company. But a 9/10 is deserved.

The negatives

Risk 3/5

Last Changed November 2023

I previously wrote:

“This negative score went from 1.5 to 3/5. The company is, as founder and CEO calls it, a paradigm shift and that raises the overall risk for the company. The past is certain, the future less so.”

This still applies, so no change for me, but I do hope we can bring this down in the future.

Competition 2/5

Last change: November 2023

This was increased slightly in November 2023, given that Paycom stated it’s trying to move into the mid-size segment. The competition here is tougher, but the company did show double-digit growth. We are maintaining the rating, but hopefully, we will get some more color on how Paycom is faring against the competition here. As we have seen in multiple screenshots, there are a lot of competitors with questionable views on profitability, and while Paycom has a track record of profitable growth, we need to see if they can maintain it.

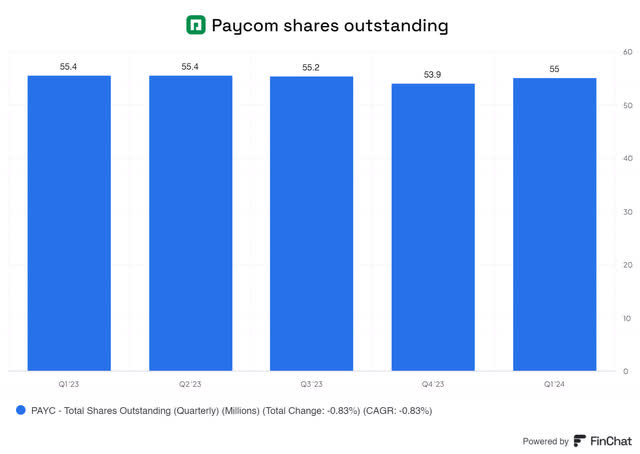

Dilution 1/5

Last changed: June 2024

While the total shares were down 0.73% year-over-year, that's not that much. Paycom buys back stocks but it also still issues shares and that makes the effect of the buybacks less powerful.

That's why I raise this (negative) score for the first time in two years. It's not that this is a disaster, but I don't want to just let it pass.

Scale Advantages Shared 2/5

Last change: July 2022

Chad Richison expects this to go up with BETI; we will raise the score when we see it. It's as simple as that sometimes.

Conclusion

Paycom's Overall Quality Score drops further, from 69.5 to 62.

The market is treating Paycom as a "show-me” story, so there is more than enough time to build a position slowly if you want. But for that, we will look at the QPI update, where we balance the quality and the price.

QPI Update

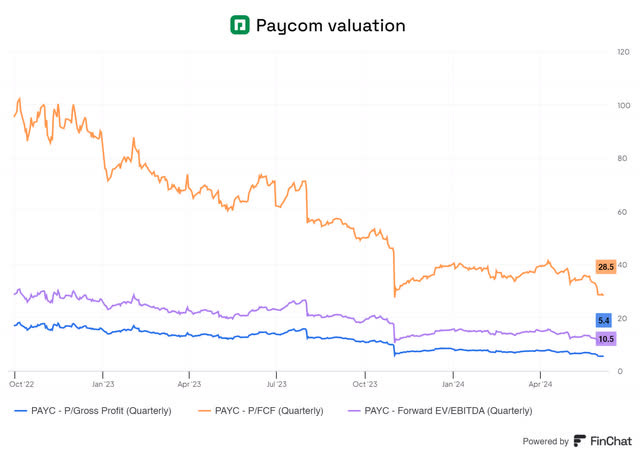

The Price/Gross Profit (as per Finchat) of just 5.4, which is very low. A P/FCF of 28.5 is not extremely cheap for a company growing at low double digits. But the P/FCF is not the best way to value this company, as it also invests money, which doesn't bring immediate cash flow.

EV/EBITDA is at just 10.5 times which is plainly cheap.

So, for valuation, even with lower growth, I think an upgrade of half a point is reasonable. So, back to 9/10, after it was brought down the last time from 9 to 8.5. At a price of around $140, I would consider this rather cheap.

That means an overall score of 15.3 (6.3+ 9), which is surprisingly good and I think it shows the value of the scores, as they take out the emotion in our evaluation of where the stock is right now.

I still expect this story to play out over the next couple of years (years, not months), and I will monitor the position. Until then, we must wait and watch if Chad Richison has one last rabbit to pull out of his hat.

Buy-Hold-Sell Scale

I still see Paycom as a buy. Now, I'm not going to add too much to my position in the PM Future Fund, as I already have a position I’m happy with, but I if you don't, there's definitely upside in this stock.

In the meantime, keep growing!