Hi friends!

Yesterday, a Multi (a subscriber to Potential Multibaggers) sent me a YouTube clip by Financial Wisdom. I’ll link to the clip further in this article, but I want to write about it first.

In the clip, Financial Wisdom uses ChatGPT to pick 20 stocks that could return the most in the next 20 years. The man does that by first priming ChatGPT by asking what the best 20 stocks of the last 20 years were. This is the answer:

Then he asks what they have in common, and then gives a prompt for an unbiased list ChatGPT would have selected 20 years ago (without hindsight bias).

As a side note, the man compares to a trading signal he seems to like: the 10-day exponential moving average or EMA crossing the 20 EMA. In the perfect hindsight bias portfolio, this works, but in the unbiased portfolio, which is more like real life, the performance with the indicator is almost 70% lower: "just" $1.51 million versus $4.8 million.

The man says the performance is 'still solid' and points out that the drawdown was significantly less than the buy-and-hold strategy, which would have turned $100K into $4.8 million. To each their own, of course, but I don’t mind volatility too much and as you see, it can cost you a lot of money—$ 3.8 million in this case.

The last step is the selection ChatGPT makes: 20 stocks for the next 20 years. This is the list. (Don't look at the red line; that's just YouTube's time bar.)

The funny thing is that I have 14 of these 20 in my portfolio. Thanks for the confirmation, ChatGPT. :-)

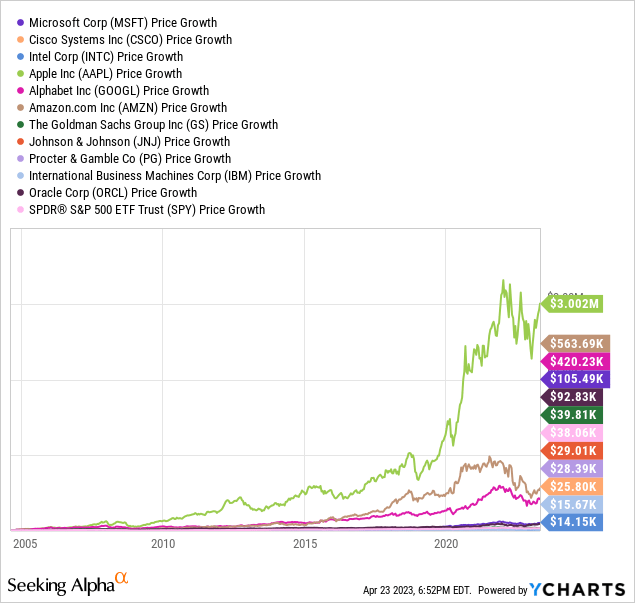

Now, just to make sure, there will be losers on this list. But the winners will outperform the losers and still deliver exceptional returns for your portfolio. This is the 'unbiased' portfolio that ChatGPT picked from 20 years ago.

I have left out Dell and Yahoo! because they have no consistent history over that period. Yahoo! was bought and Dell was taken private in 2013 before again IPO'ing in 2018.

As you can see, 9 of the 17 stocks underperform the market. That's more than 50%. But the winners make up for that and much more.

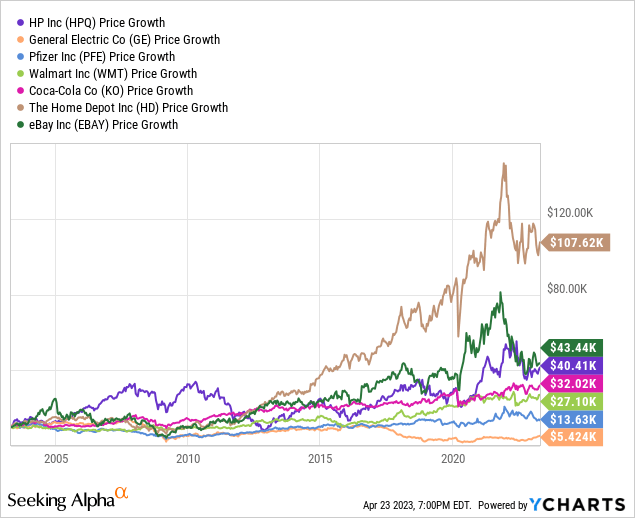

These are the results of the unbiased performers. The portfolio includes the losses of Yahoo! and also Dell.

You can have many questions about how unbiased this ChatGPT selection really is, of course, how high the quality is and if these stocks will really outperform. After all, there is no proof of this yet. And there's also a mistake, as Google didn't have its IPO until 2004.

But there are also some lessons I think are CRUCIAL for the Potential Multibaggers approach to investing.

The average annual return is 24.3%

The maximum drawdown is 52%

This is a buy-and-hold portfolio

The few huge winners carried the portfolio to an outstanding performance.

The upside is so much bigger than the downside.

These are all essential elements of the Potential Multibaggers investment philosophy. You will have losers, you will experience significant drawbacks but over a longer period, just a few stocks will carry your portfolio to big highs.

This is the full clip if you want to look.

If you don’t want to miss my updates here, please subscribe. Sharing with friends or on social media is highly appreciated!

In the meantime, keep growing!

If you want to see my portfolio, there’s a 2-week free trial for Potential Multibaggers!