Celsius: What's going on?

Hi Friends!

As you may know, last week, Multibagger Nuggets has become totally free! What this means is that you will regularly get articles from Potential Multibaggers for free. There will be some delay and you will only get a small selection of my articles there, but it will give you a taste of how much more thorough I work there than here up to now. If you want to see the real deal, including my portfolio, for example, there’s a 2-week free trial and a 20% discount if you stay if you use this link. If you don’t want the full service, don’t forget to subscribe to Multibagger Nuggets.

I want to start with a confession. I have never drank Celsius, because it contains guarana, to which I had an allergic reaction once. So, I don’t dare to drink it. But even if I would, I don’t think I represent the average Celsius drinker. What counts here is that the company is growing like gangbusters. But this is not a cybersecurity business that will remain relevant for years. We have to be watchful for growth inflections.

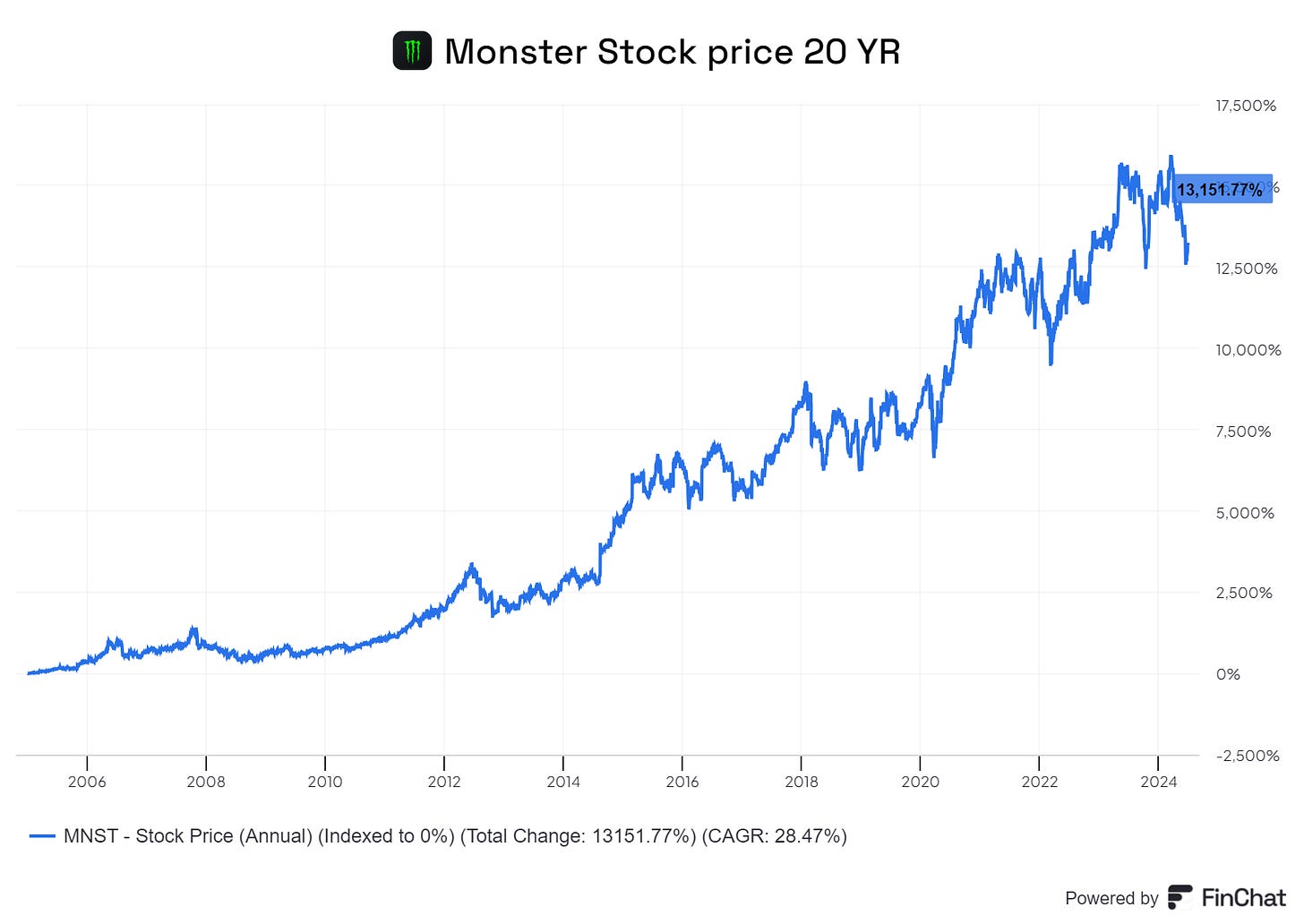

I think one of the biggest reasons investors get excited about a new fast-growing energy drink brand, is because of this chart

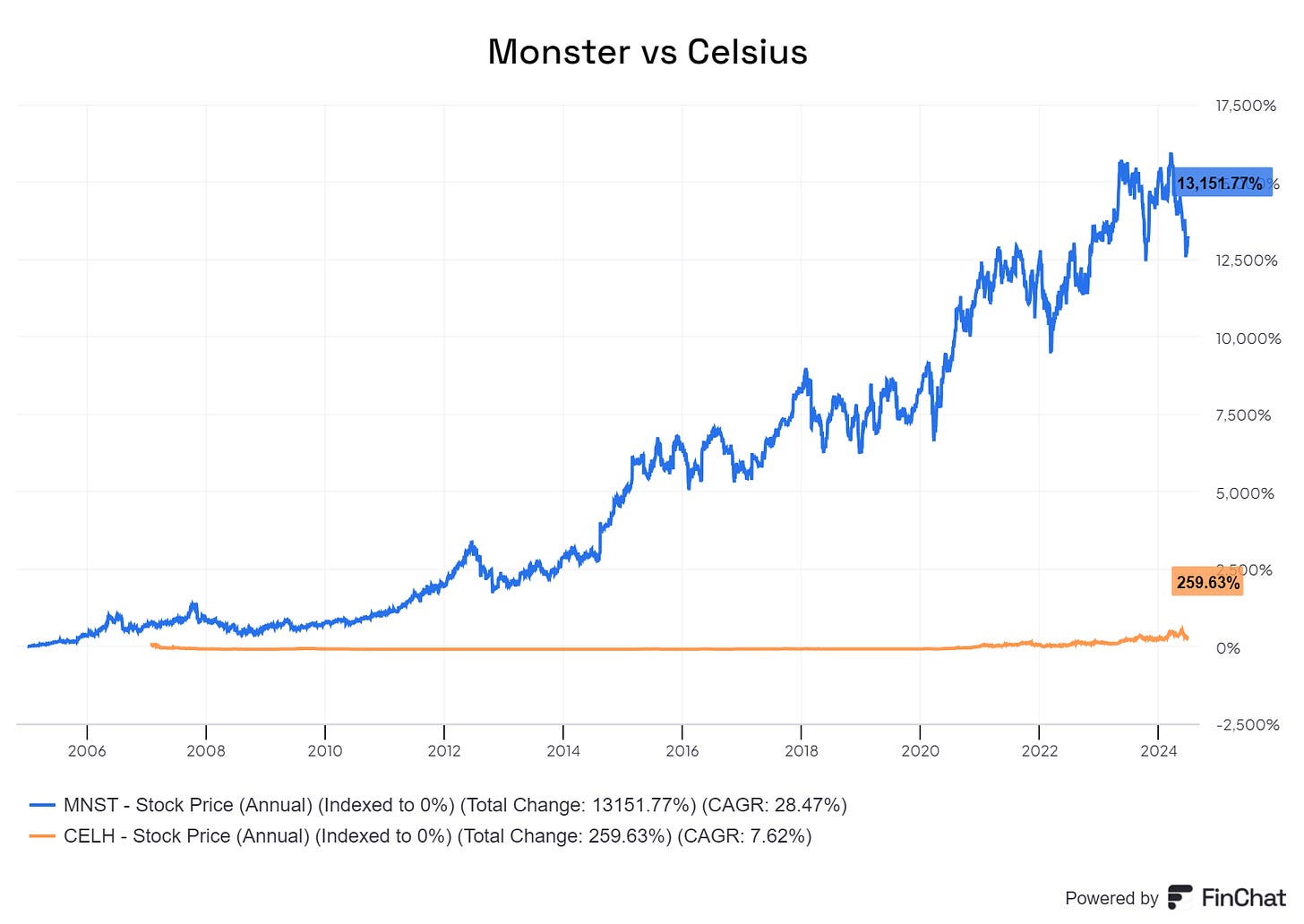

Look at that, Monster is famously one of the greatest stocks in the history of capitalism, we can all dream of a future where CELSIUS can do the same. Let’s see how it’s doing so far, here is Celsius since inception

Celsius went public only 10 weeks after Monster did. The stock was delisted in 2008 and then went public for the second time in 2017, but it was trading in the OTC markets throughout as a lost relic of the energy wars. So, what happened? Did they discover the magic drink that set them on their path?

Nope, they didn’t. Celsius the drink has been around since 2009, it just took more than a decade to figure out distribution and supply chain.

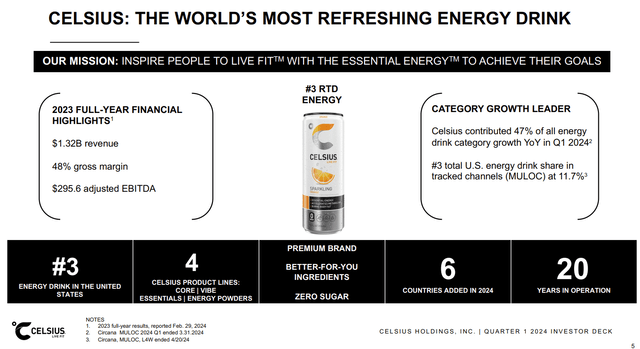

Celsius isn’t a new-fangled upstart hoping to usurp Monster; it’s an old company (founded in 2004, with the first IPO in 2007) that has only recently gotten their act together when it comes to marketing and distribution.

And this is the key to understanding Celsius, boring old operations and supply chain. Sure, the flavors and product innovation matter, but as Coca-Cola has shown us, those are secondary to getting the product onto shelves and getting the word out for consumers to buy it.

Don’t you believe me? Here is a brief but entertaining summary of news headlines regarding how popular Celsius is: (All times in EST)

Tuesday, April 9, 2024:

Celsius, Starbucks, McDonald's and e.l.f. Beauty stand out in a survey of teenagers | Seeking Alpha

Tuesday, April 23, 2024

Tuesday, May 7, 2024, 6:19 AM:

Celsius Holdings slides after a rare revenue miss with its Q1 earnings report | Seeking Alpha

Tuesday, May 7, 2024 , 10:36 AM:

Celsius Holding pares an early decline after investors look past inventory issue | Seeking Alpha

Thursday May 9’ 2024:

Celsius Holdings pops after investors become re-energized by the growth story | Seeking Alpha

Tuesday, May 14 2024:

Tuesday, May 28 2024, 10:08 AM:

Celsius Holdings slumps after Nielsen data cools off a bit; PepsiCo also lower | Seeking Alpha

Tuesday, May 28 2024, 3:30 PM:

Celsius Holdings pares its loss after several analysts call the sell-off overdone | Seeking Alpha

The Celsius story literally changes from Tuesday to Tuesday. Personally, I find anyone believing the Nielsen data to be the holy grail for investing in the stock quite hilarious, but I bring this out to tell you how much noise there is around small-cap growth stocks. They're great for day traders, though.

The key is this: The stock has 10-bagged since 2020, initially part of the COVID recovery, but the fundamental performance kicked into high gear once Pepsi invested $550 million and became the de facto distribution agent for Celsius. Finally, after almost 20 years of struggling, Celsius can compete with Monster, which is backed by Coca-Cola, on an equal footing. You can clearly see this in the results, which we will explore now.

The Numbers

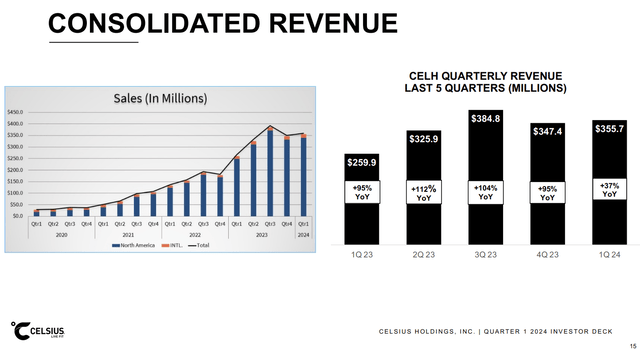

Q1 2024:

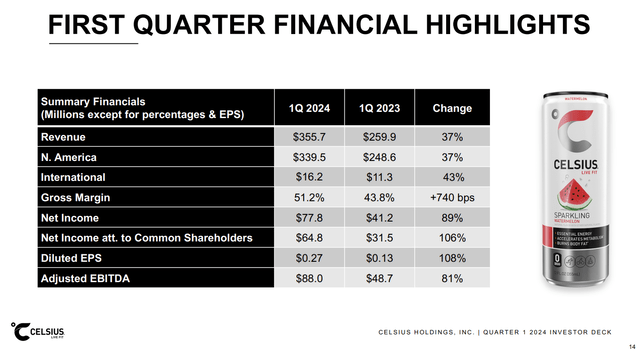

Revenue: MISS

Revenue of $355.7 million (+36.9 % Y/Y) misses by $34.12 million.

One of the reasons for the sell-off was the “slowing growth”, but this is to be expected as you get larger and larger, and especially when the Pepsi deal leaped. So, while triple-digit growth was impressive, it is something in the rear-view mirror.

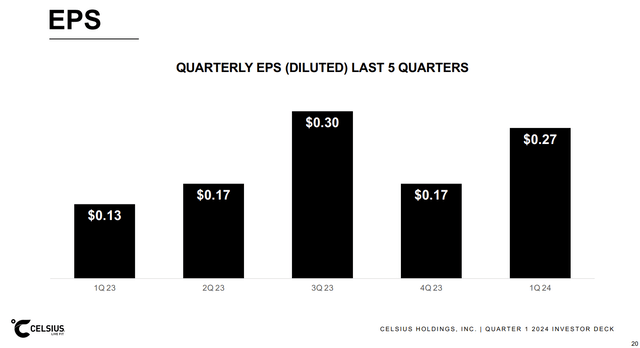

EPS: BEAT

Q1 GAAP EPS of $0.27 beats by 0.08, up 108% YoY

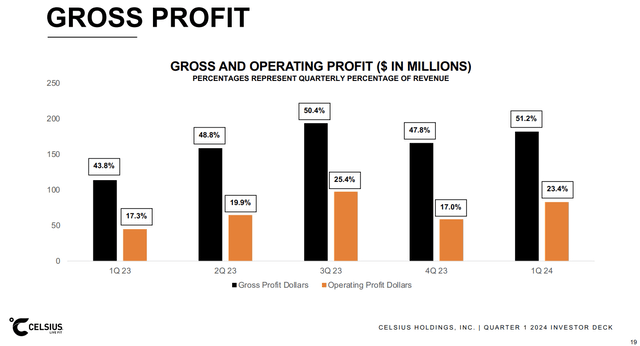

Gross Profit:

$182 million, a 60% increase YoY. Gross profit margin stood at 43.2%, from 40.2% in Q1’23. Gross profit as a percentage of revenue was 51% for the three months ended March 31, 2024, up from 44% for the prior-year period, as a result of lower freight and materials costs.

Business Metrics:

Average SKUs (Stock Keeping Units) per retailer increased in the first quarter of 2024 to 20.6 from 13.5 in the prior year. TDPs (Total Distribution Points) for the quarter grew 55% year over year and 27% sequentially.

Gross Margin:

51%, up 740 bps YOY

Those are strong numbers.

Business Growth:

John Fieldly, Chairman and CEO of Celsius, said:

Celsius reported its best first quarter ever, driving record revenue and contributing 47% of the quarterly year-over-year growth in the energy drink category. Our category share of 11.5 percent as of April 14 reflects the early impact of shelf space gains that we are earning from company-record and ongoing retailer resets, which we believe will serve as a flywheel for our continued growth. Celsius product innovation this year has delighted consumers with the most refreshing products we've ever created.

Jarrod Langhans, Chief Financial Officer of Celsius, added:

Celsius' first quarter revenue of $356 million and year-over-year growth of 37 percent is a record, despite changes in days on hand inventory by our largest customer. Our solid 51 percent first quarter gross margin reflects a balanced and disciplined approach to leveraging while simultaneously building the business and expanding globally, as well as an accelerated benefit from raw materials pricing and reduced freight costs.

Inventory movements within our largest distributor where first quarter 2024 inventory days on hand declined versus the fourth quarter resulting in an approximate $20 million impact, while first quarter 2023 revenue benefited from an inventory buildup of approximately $25 million. Ongoing inventory fluctuations may be expected in subsequent quarters because our largest distributor constituted 62% of our total North American sales during the first quarter of 2024.

This is the point I was making earlier, if you want to own Celsius, you have to understand boring retail metrics like inventory, stocking, de-stocking instead of fickle monthly market share. An inventory move can have a much larger effect on numbers than Jake Paul slurping Extra Dimensional Fruit Vibes laced with controlled substances (just an illustration, don’t get me sued for making a joke.)

From a longer-term perspective, however, what matters is unit volume growth. Some key highlights:

retail sales of Celsius in total U.S. MULOC grew by 72.1% in the first quarter of 2024 year over year, and subsequent-period sales show ongoing consumer demand, as reported by Circana for the period ended April 21, 2024, (L1W +48.8% YoY; L4W +51.0% YoY; YTD +67.2% YoY)4. Revenue from U.S. and Canadian sales are reported together as North America.

(Note: “MULO-C” stands for “Multi Outlet with Convenience Stores”, aka Food/Grocery stores, Drug Stores, Mass Merchandizers, Walmart, Club Stores (ex-Costco), Dollar Stores, Military Ration Stores etc. Basically, in most places, you can buy Celsius.)

International sales of $16.2 million increased 43% from $11.3 million for the prior-year period, driven by ongoing velocity improvements and product launches. Club channel sales in the quarter ended March 31, 2024, increased 36% to $63.0 million compared to $46.5 million in the prior-year period. Celsius sales on Amazon increased 30% in the quarter ended March 31, 2024, compared to the prior-year period, to approximately $28 million, and Celsius remained the #1 energy drink brand by dollar share. Case volume in the food service channel increased 186% year over year and grew 113% quarter over quarter. Approximately 12% of Celsius' total sales to PepsiCo in the first quarter of 2024 was to the food service channel.

We estimate that retailers' spring shelf resets were approximately one-third complete as of March 31, and once concluded, we are expecting our best shelf space gains in company history. The importance of these space increases and placement improvements cannot be overstated. The visual impact of multiple, full shelves of cold Celsius in convenience store coolers and on grocery shelves is a powerful in-store billboard and showcases more of the Celsius product portfolio. The full effect of shelf space gains is expected to be reflected in scanner data beginning in July 2024.

In Summary, we see Celsius is growing despite a broader slowdown in the energy drink space, and they continue to expect share gains heading into July once re-stocking is complete. Remember, people most want cold, fizzy drinks when the weather is hot, so Q2 and Q3 are crucial for the company.

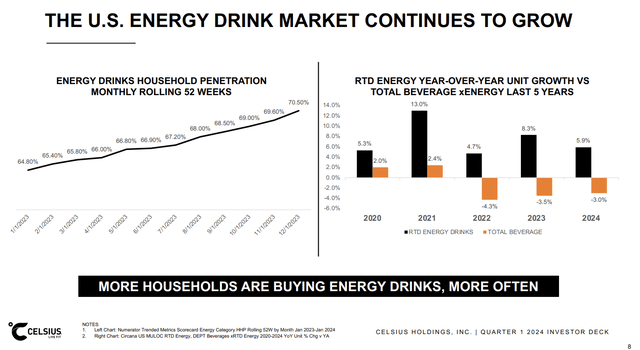

Energy Drink Market

We saw Celsius attempting to “have their cake and eat it too” by first announcing:

This share performance delivered quarter-over-quarter sales growth for Celsius of 9.6% during a period when the energy category declined 0.4%. Sugar-free segment sales in the first quarter were approximately 50% of the energy drink category.

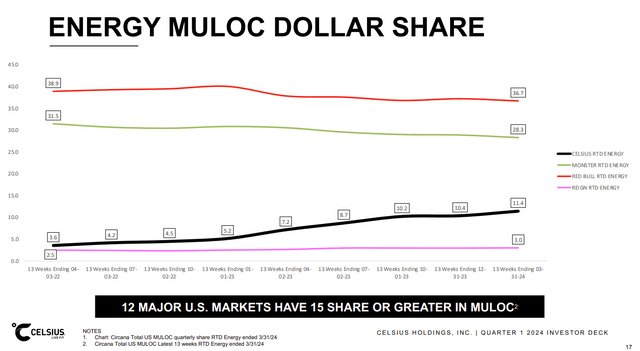

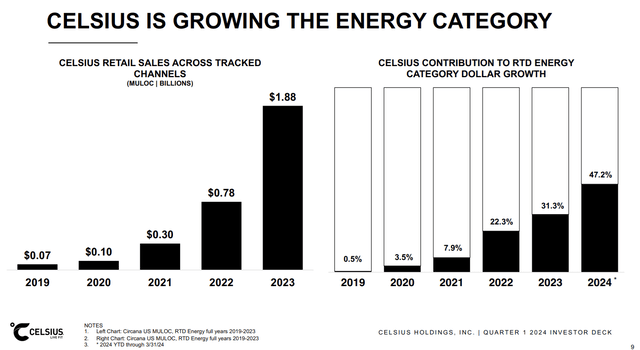

While at the same time producing these charts:

I understand the point they’re trying to make, which is that they are single-handedly holding up the entire energy drink category, but it's still funny to see the 2 on the same slide.

However you slice it, if you’re bullish on energy drinks, these are great numbers that help expand the market rather than simply battling established players.

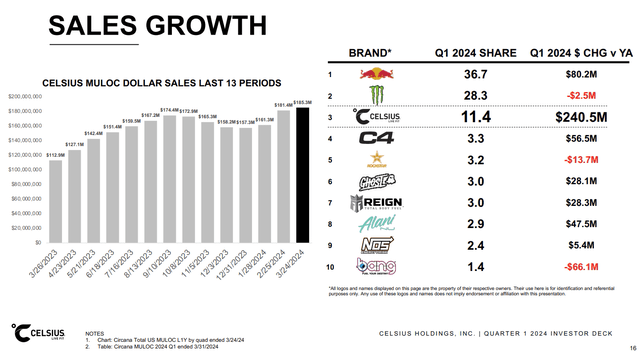

Celsius also produced this great chart on how the industry itself is currently split:

That’s encouraging to see: it is now firmly the “Best of the Rest” and far outgrowing the competition.

Innovation & Marketing

Celsius continued to experiment with flavors and offerings and shared some updates in this regard:

Sales of Celsius Essentials continue to exceed expectations and have reached 54.5% ACV (All Commodity Volume or store’s total sales of all products relative to the sales of all relevant retailers in a given territory) and 4.1 average items sold per store. Celsius Essentials were sold in over 95,000 stores in the first quarter of 2024.

Celsius introduced new, refreshing 12-ounce flavors in the first quarter, including Celsius Blue Razz Lemonade, Celsius Raspberry Peach, Celsius Astro Vibe, and Celsius Galaxy Vibe, as well as new variety packs.

Celsius On The Go powders reached the #1 position in the energy powder category in the first quarter of 2024 and have increased category share by 1.7 points since January 2024 to 24%12.

Celsius hosted high-profile influencers and celebrities during the first weekend of the Coachella Valley Music & Arts Festival at the Celsius Cosmic Desert event featuring the Celsius Space Vibe Trilogy (CELSIUS Cosmic Vibe, CELSIUS Astro Vibe, CELSIUS Galaxy Vibe) with exclusive performances by artists T-Pain, Two Friends, DJ Xandra and more. Kris reported this in the Overview Of The Week.

The marketing machine continues in full swing.

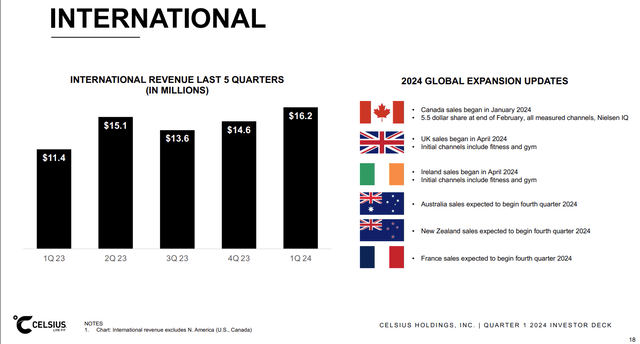

International Expansion

A key part of being a big winner in CPG is going international and there was great news in this regard:

Sales in Canada began in the first quarter of 2024 and continue to exceed pre-launch expectations. Celsius' share in the energy category in MULOC in Canada was 5.5% as of Feb. 29, 2024, according to Canadian NiQ data.

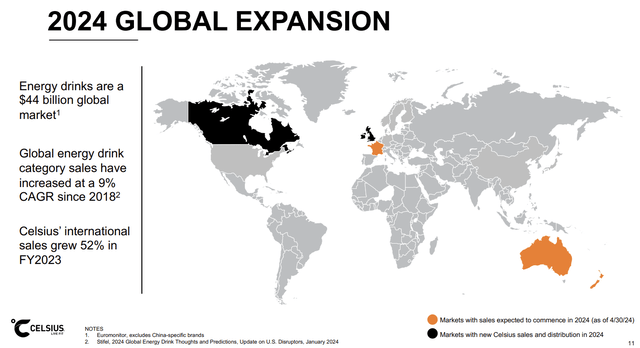

In the first quarter, Celsius announced plans to expand its sales and distribution into Australia, France, Ireland, New Zealand, and the United Kingdom in 2024. Sales in the UK and Ireland began in April through the fitness channel and in select gyms. Sales in Australia, France and New Zealand are expected to begin in the fourth quarter of this year with broadening reach throughout 2025.

I thought this was a very cool chart:

As they say, the runway is long and we will need to see how they compete with incumbents like Red Bull and strongholds like Monster.

Stock-Based Compensation

In this regard, Celsius does a great job. SBC was only 3.5 million during the quarter, down from 5.5 million in Q1’23.

Given that FCF was 127.6 million, this is outstanding and a significant improvement over Q1’23, where FCF was -17.7 million. This is operating leverage at its finest.

Balance Sheet

Cash, cash equivalents and short-term investments totaled 879.5 million as of March 31, 2024, which is more than comfortable.

In a departure from most of my other articles, I don’t have many insights to share from the conference call where the vast majority of questions were around the inventory, which I won’t belabour too much given I’ve covered it already. That’s all Wall Street analysts care about with regards to their modelling, but as long as Celsius continues to grow revenues and profit every year, short term fluctuations should even themselves out.

Summary

This was a solid quarter from Celsius. Their maturity in marketing, sales, distribution, and supply chain is showing as the company becomes a serious competitor to the big boys in its space (Red Bull and Monster). The Pepsi distribution deal is paying dividends in turbocharging growth, but it can lead to short-term fluctuations like we saw this time around. I wouldn’t worry too much about it. Overall, there are no red flags here; the company continues to execute well.

In the meantime, keep growing!