Alphabet's Earnings: A Very Short Analysis

5 minutes to know the essence of Alphabet's earnings.

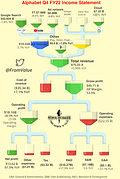

Last week, on Thursday, Alphabet reported its earnings. I wanted to review the earnings quickly, starting with an earnings visualization.

Some important takeaways here:

Revenue is up less than 1% to $76.05 billion but that would have been 7% without currency headwinds.

Ad revenue was down 3.7% year-over-year, mostly because of lower revenue for YouTube, -8.4% and Ad Network, which consists of AdMob, Adsense and Google Ad Manager, down 9.8%.

Google Cloud, which includes Workspace and APIs among other things, remains very strong, with 32% growth.

Other, including the Pixel, Fitbit, the PlayStore, YouTube Premium, YouTube TV, Nest etc. was up 7.8% year-over-year to $8.8 billion.

Net profit came in at $13.62 billion, down 51.5% year-over-year, which resulted in EPS of $1.05, still beating the consensus by $0.14.

Operating profit was down 20.5% year-over-year.

The company remains financially very healthy. While it has debt and leases for $26.2 billion, it has $139.6 billion in cash and short-term investments.

Some background

While the numbers may not look strong, the comps were very tough. In last year's Q4, Google Search grew 44%, and YouTube 25%, for example. Management said growth should resume once these tough comps are in the rearview mirror.

Google Cloud was very strong again, with 32% growth. Some point to the 38% growth in the previous quarter to say this is a weak result, but if you compare it to Microsoft's Azure, 31%, and Amazon's AWS, 20%, this growth was the fastest of big tech.

While these numbers may not look solid, free cash flow tells another story. It was up 47% year-over-year, despite the currency headwinds. Alphabet has taken measures to be efficient and that $16 billion in free cash flow shows that. If you annualize that, you get $64 billion in free cash flow. That means Alphabet only trades at 21 times its fictional annualized free cash flow. If we can believe analysts, it's probably even closer to 19 times forward free cash flow. To me, free cash flow will always be the most important way to value a mature company like Google.

If you look at the current free cash flow, you see that Google trades at 23 times free cash flow, which is the cheapest it has since the period after the Great Financial Crisis.

As you can see, on a forward enterprise value versus EBITDA, Google trades at a very reasonable 10.66 times. FASTGraphs suggests a quite deep undervaluation when you look at the price and compare it to EBITDA. As you can see, historically, Google's stock price correlates with EBITDA almost perfectly, but not now.

At the same time, that free cash flow is also put to work, which is another highlight for me. The company bought back $59 billion of its own shares in 2022, reducing the sharecount by about 3%. That's not bad at all for one year.

A reason for concern is the Department of Justice's case against Google. It could lead to the divestment of Google Network, which accounts for low double digits of the company's revenue. There could also be just a fine. We will have to see about that.

But there's also optionality in Google, especially in AI and quant computing. CEO Sundar Pichai:

Our long-term investments in deep computer science make us extremely well-positioned as AI reaches an inflection point, and I’m excited by the AI-driven leaps we’re about to unveil in Search and beyond.

When I wrote this article, I wrote this sentence: “That probably means that Google is about to launch a ChatGPT-like function, coupled with its Search.”

Shortly after I had written this, Google already announced that its ChatGPT competitor Bard will be rolled out to wider availability in the next weeks.

Of course, this could mean short-term pain if that new tool takes away (some) of the profits of Search. Again, we will have to see.

Conclusion

Overall, I'm happy to be a Google shareholder. With this low valuation, I think many risks are already baked into the stock price. Of course, just as for any investment, there are risks. Usually, when companies are bigger, people ignore them more. It's one of the reasons why I don't overweight big tech in my portfolio. The history of the stock market often shows that the market leaders are not always the best investments. Although stable, they can have eroding moats without investors noticing it. But I think Alphabet has enough optionality not to be disrupted fast.

If you don't own any shares and want to be a shareholder, I think the valuation is very reasonable now, bordering on cheap.

In the meantime, keep growing!

I can understand now why people follow you. Even I could understand what you explained. Very interesting! @atelierm2018